In brief

- There have been more Tether-based transactions on the TRON blockchain than on Ethereum every day so far in 2021.

- Despite controversy, Tether remains by far the largest dollar-pegged stablecoin, with nearly $25 billion in circulation.

- Combined volume of Tether transactions on Ethereum are still about double the value of those processed on TRON.

We do the research, you get the alpha!

Tether transactions are on the rise, but in a different place than you might expect—high fees on Ethereum appear to be pushing people to use TRON for transfers of Tether, the world’s most-popular stablecoin.

There have been more Tether transactions (though not higher volume) on the TRON blockchain than the Ethereum blockchain every day thus far in 2021, according to blockchain data provider CoinMetrics. That’s in spite of Ethereum housing more than 50% more Tether tokens than the TRON blockchain.

It could be a warning sign that high fees will drive crypto traders to alternative blockchains, threatening Ethereum’s position as the de facto center of the crypto trading universe.

Founded in 2014, Tether provides dollar-pegged stablecoins on blockchains such as Ethereum, TRON, and Solana. Stablecoins are used by crypto traders as stable assets like cash as a means of moving out of positions in volatile cryptocurrencies. They also make many crypto transactions easier by providing a more familiar currency unit for settling debt or reporting interest rates.

Tether is by far the largest provider of stablecoins with a circulating supply of approximately $25 billion, a figure that increased nearly 4x over the course of 2020. Tether claims all Tether tokens are 100% backed by cash and cash equivalents, but skeptics routinely question that assertion, and Tether remains the subject of an ongoing lawsuit in New York state over an alleged cover up of the loss of more than $800 million in customer funds.

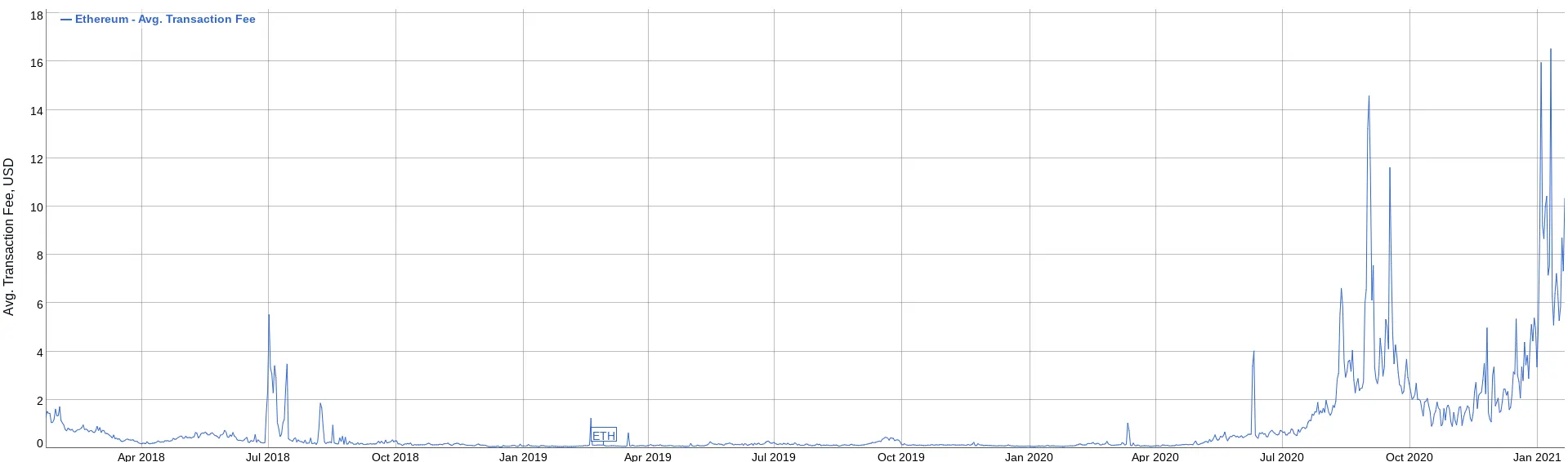

Transaction fees on Ethereum have remained elevated at an average of more than $6 per transaction for all but two days so far in the new year. They went above that level only a dozen days over all of 2020, according to blockchain data provider BitInfoCharts.

Transaction fees on Ethereum started rising above historic levels in May 2020, thanks to a boom in Ethereum-based DeFi (decentralized finance) applications that seek to replicate financial services like loans, asset swaps, and interest on customer deposits via decentralized networks using smart contracts. By contrast, TRON fees amount to fractions of a cent per transaction, on average.

TRON founder Justin Sun has previously discussed copying Ethereum as a means of bringing more activity to the TRON blockchain. Even so, the total value transferred on the Ethereum blockchain using Tether tokens has remained nearly double that transferred via TRON since January 2020, indicating that the increased number of TRON-based Tether transactions are coming from relatively small traders dealing in lower amounts.

Nevertheless, high fees on Ethereum may incentivize Tether users to jump ship and bring some much needed vitality to competitor chains like TRON, as long as such rivals can keep their own fees low.