We do the research, you get the alpha!

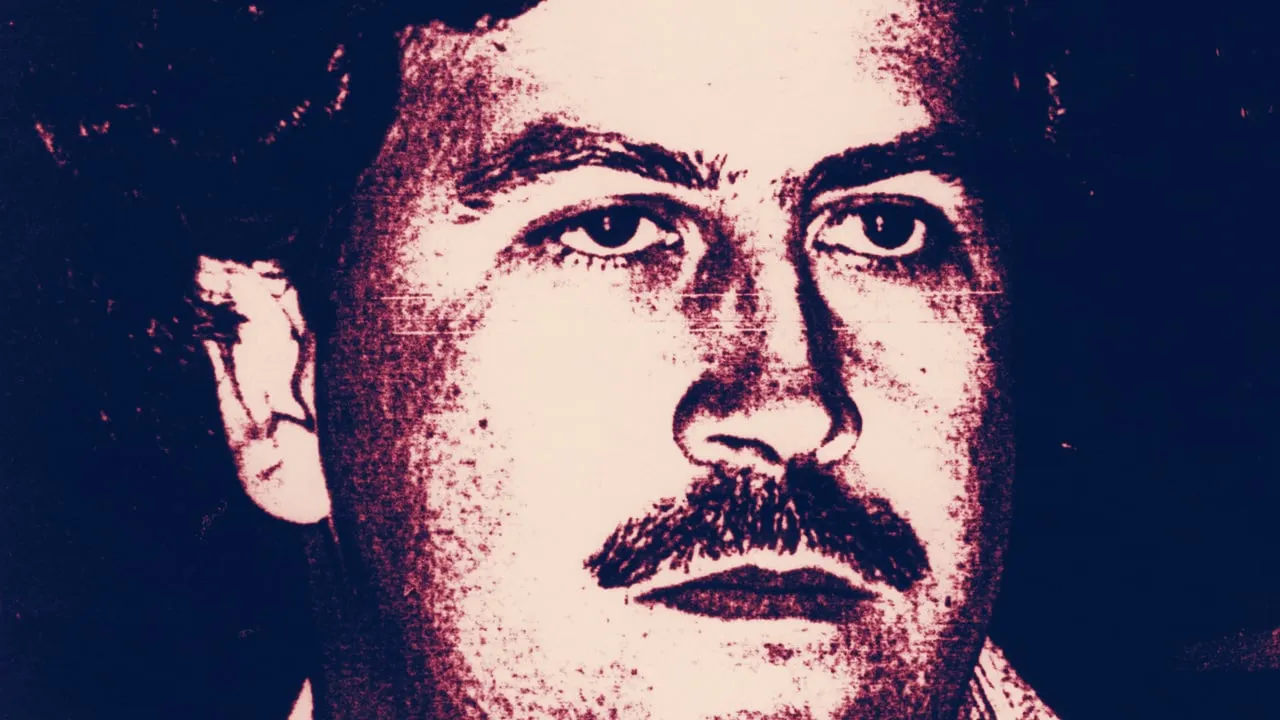

In the 1980s and early 90s, while Pablo Escobar stood atop the world’s cocaine industry, it was his brother, Roberto, that did much of El Padrino’s dirty work.

Not only was Roberto in charge of the numbers for the Escobars’ multi-billion-dollar empire, he also ran the Medellin Cartel’s squad of hitmen—the hired guns responsible for a reign of terror that led to Colombia’s ascension as the “murder capital of the world.”

These days, after a 10-year stint in prison and an attempt on his life that left him partially deaf, the brother of the world’s most notorious drug lord now has set his sights on crypto—where he can continue to pursue at least one of those passions.

And, perhaps unsurprisingly, Escobar’s crypto escapades are not without controversy.

Several investors in two ICOs run by Escobar that purportedly raked in millions say they personally sunk tens of thousands of dollars into projects that they now believe are a scam. Ironically, the investors admit that the same thing that intrigued them about these ventures to begin with—the Escobar name and legend—is now what prevents them from taking any further action, or seeking help from regulatory authorities.

“Many of the investors don’t want to get involved,” said a source who dropped a “few thousand” into Escobar’s crypto project. “[It] might be the last thing you do.”

Escobar’s answer to “CIA-run” Bitcoin

In March 2018, Roberto Escobar, along with co-founder of Escobar Inc. Olof Gustafsson, launched a new crytocurrency dubbed Dietbitcoin (DDX). Dietbitcoin was, initially, designed as a Bitcoin fork and marketed as a “lighter and faster” version of its predecessor. But its real appeal for users was its “anti-establishment” flair, said another investor.

“[I got in] because of the name ‘Pablo Escobar,’” he said. “Not many [others] want to admit this, but the initial thought that comes to mind is ‘black market.’” The idea that Escobar could potentially launch the native currency of the next Silk Road was enough to convince him to drop $10,000 in the DDX ICO, he said, adding that several others put in more than $20,000 each.

Among the many tall tales within the original Dietbitcoin whitepaper, Escobar claimed to have met the “real” Satoshi Nakamoto, even going so far as to provide a supposed copy of Satoshi’s passport. He said he became convinced that Satoshi was, in fact, an agent of the “American government,” and that Bitcoin was an invention of the CIA.

The marketing effort was enough to pull in more than $1 million in its ICO, said the investor, even though Escobar Inc. never disclosed how much it raised precisely.

However, within months, Escobar Inc. seemingly abandoned the project, leaving the DDX “community” to fend for itself. “They basically just left the coin as a Bitcoin fork and put no time into partnerships or integrations,” said the investor. “The chain was stuck for a week [until] a member fixed it up for them.” The investor explained that DDX only ever made it onto two exchanges before the team behind the project eventually resurfaced with a new plan.

In March of this year, Escobar relaunched DDX as Dietbitcoin 2.0, an Ethereum-based ERC-20 token, which the company said would be 1:1 swappable with the original Bitcoin-based DDX. But much to the dismay of the original DDX investors, the coin’s supply had been increased from a max of 21 million (matching Bitcoin’s total supply) to 55 billion tokens—a move which slashed each token holder’s investment to less than 1 percent of its original value.

“Basically, my $10,000 worth of around $200 [per token] on the old chain turned into $0.20 [per token] on the ETH chain,” said the investor.

Escobar Inc. did not respond to Decrypt’s requests for comment. And it seems that many of the investors that have attempted to get answers from the company have not had much better luck.

Another stakeholder in Escobar’s Bitcoin alternative told the Spanish-language crypto news site CriptoNoticias that he sent “many emails to the support team” only to be told that they had moved on to “another platform” and that he would need to simply reinvest more money to get the equivalent number of tokens back.

The coin to “impeach Trump”

Meanwhile, as DDX investors were left languishing in 99 percent losses, Escobar Inc. would try its hand at a second cryptocurrency project—an Ethereum-based stablecoin called, appropriately, ESCOBAR.

In a move that could charitably be described as a publicity stunt, Gustafsson told The Next Web earlier this year that the company launched the stablecoin as a way to finance a campaign to impeach U.S. President Donald Trump.

Gustafsson said at the time that Escobar Inc. had raised $10 million of its $50 million goal in fiat on GoFundMe “in just 10 hours,” before the “the Trump Administration” supposedly shut the page down. Raising money instead in ESCOBAR would prevent anyone from “censoring” the project again, he said.

The campaign, however, never went anywhere. The stablecoin has been deserted, the ESCOBAR website is now a ghost, and El Padrino’s brother has since publicly denied ever being a part of it.

It’s unclear how much Escobar Inc. ultimately raised in this effort, but investors in Escobar’s DietBitcoin scheme say they aren’t surprised to see this project, too, go up in smoke.

After all, anyone who bought into Escobar’s crypto snow job should have seen this coming, one of the investors said. “We all accepted the fact that we were fools in the end. It’s the Escobars. What did we expect?”