We do the research, you get the alpha!

Call it the revenge of the DAO. Three years ago, one of the boldest experiments in decentralization—a distributed, user-owned incubator known as the DAO—suffered a humiliating and expensive hack. Some $50 million was lost, and a subsequent fork of the Ethereum network, intended to roll back the losses, created a deep, ideological rift in the Ethereum community.

Despite the setback, a number of true believers haven’t abandoned the idea.

Last week, a new DAO, known as dxDAO, was launched with a promise to be more secure, more decentralized and a vast improvement over the original. Created by the developers behind crypto startups Gnosis and DAOstack, dxDAO has already accumulated $12 million from a variety of mostly anonymous investors. It’s attempting to use prediction markets for governance and has set its sights, initially, on running a purely decentralized crypto exchange—a move that’s both likely to attract the attention of regulators and possibly show its ability to outrun them.

“It’s an experiment to start a startup with 1,000 cofounders,” said Martin Koeppelmann, the CEO and founder of Gnosis, a prediction market whose devs helped build the new DAO.

"DxDAO is, to my mind, one of the first large scale DAO experiments—truly a DAO in practice, not in name only— that has existed on blockchain since the very first DAO experiment," said Kirk Dameron, a ConsenSys grandee who was deeply involved in the "cleanup" of the original DAO and has been following the dxDAO project closely.

"It enables a vastly powerful new means of human coordination," he said. "It will, at a number of margins, move power from the centers, to the edges. How will humans react to it? We don't know. Will it hold up or be hacked? We don't know. Will it become just another failed experiment, or a powerful DAO that will change and evolve in interesting and no doubt fascinating ways for decades? We don't know."

Kingslayer

The idea of a DAO (or “decentralized autonomous organization”) is fundamental to modern crypto. Rather than being hierarchical and managed from the top down, the DAO does away with CEOs, a board, and old-fashioned equity-investment. Instead, the firm is more of a co-op, owned and controlled by everyone who buys into it. Decisions are supposed to serve the collective good, are consolidated in code, and are executed using smart contracts.

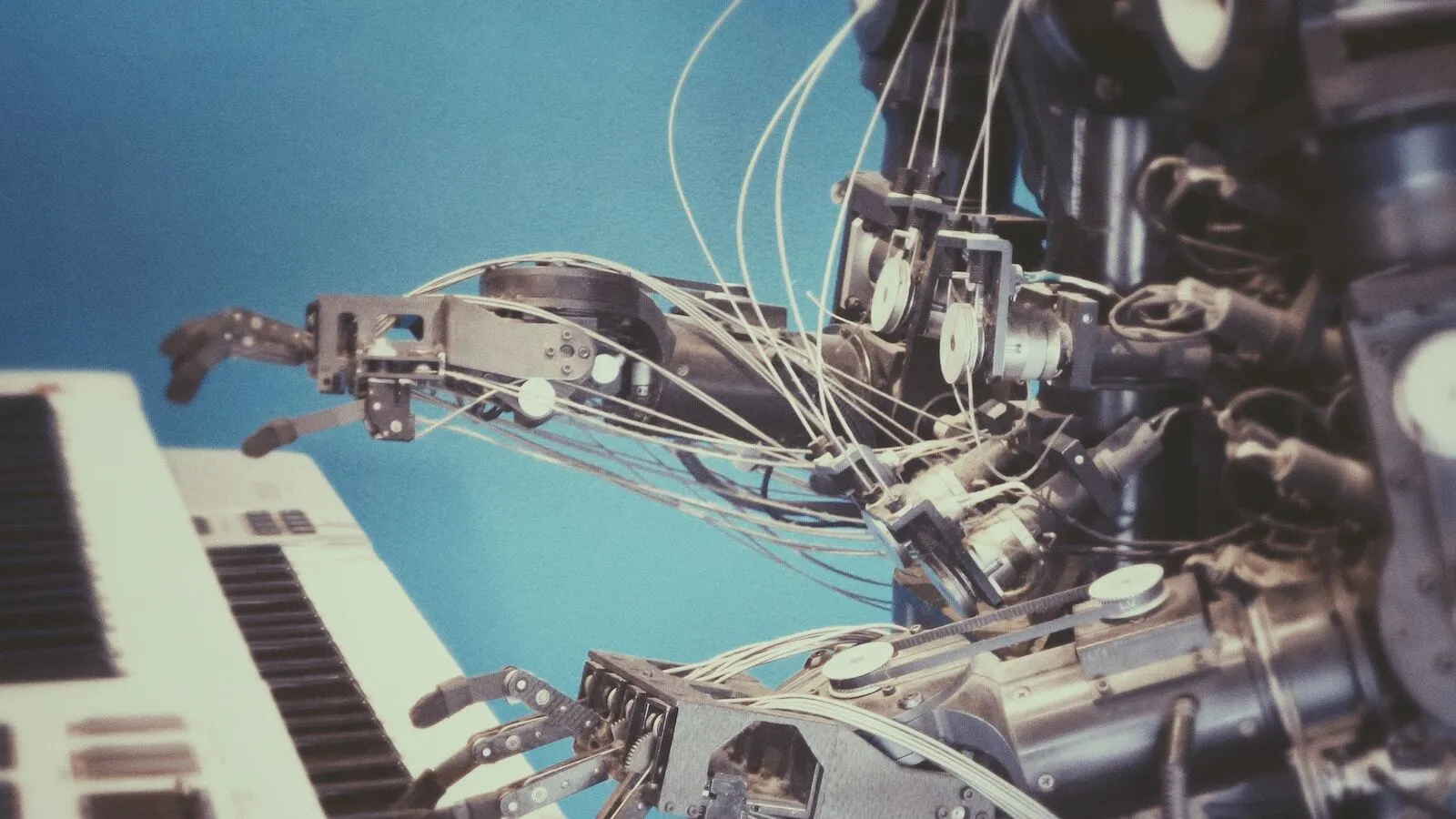

The hack of the first DAO notwithstanding, the philosophical issues raised by the prospect of a headless, fully distributed firm are as consequential as they are technical. With the fully automated future approaching, it's increasingly urgent to figure out how humans will fit into a world dominated by ones, zeroes and benevolent algorithms. Some futurists anticipate a self-sustaining hierarchy of machines, a holistic Internet of Things, with driverless cars paying congestion fees to ownerless parking meters as they ferry mechanical passengers across leaderless nations.

The DAO, in theory, lets humans wrest back a degree of control.

The idea for a distributed autonomous companies appears to stem from a piece written by Block.One founder Dan Larimer in 2013 in which he described a “Decentralized Autonomous Corporation:

“Think of a crypto-currency as shares in a Decentralized Autonomous Corporation (DAC) where the source code defines the bylaws. The goal of the DAC is to earn a profit for the shareholders by performing valuable services for the free market. With this goal in mind set out to maximize shareholder value at every stage as you design the bylaws that govern operation of the DAC.”

But other early thinkers, including Ethereum co-founder Vitalik Buterin, were fascinated with the notion of companies run by code, and built on the concept, which has evolved over time.

Peak decentralization

While the original DAO was essentially a novel crowdfunding mechanism, dxDAO’s primary focus is giving its members full, executive control. Its 232 investor/owners can be anybody with an Ethereum address, meaning they can be anonymous, and hold voting rights in proportion to money staked on the network. That allows them to make, and vote on, propositions about how the DAO’s considerable financial resources are invested.

Putative members can join the DAO by earning “reputation,” which translates to voting rights. They do that by purchasing dxDAO’s GEN tokens, temporarily "locking down" ether or other tokens (that's where the $12 million came from—it will eventually be returned), or, most significantly, trading on a decentralized exchange called “DutchX.”

Here’s where it gets truly weird. Gnosis, the decentralized prediction market behind dxDAO, separately built DutchX, a crypto exchange which bills itself as more decentralized than all of the other exchanges.

Gnosis has given the exchange to dxDAO as a sort of gift. And last week, members began a 30-day on-boarding period—a shakedown cruise to see if the new DAO can collectively run the DutchX exchange without any central oversight. If it works, the exchange will be the DAOs first investment and a showcase of the powers of the DAO.

“The dxDAO will either develop its own life and identity independently of Gnosis — or perish,” a Gnosis blogger wrote in the dxDAO's recent launch post.

At this level—let's call it Peak Decentralization—a sort of magic happens. A true DAO, said Dameron, "cannot necessarily be 'shut down' or ''stopped' by any human jurisdiction, nor be straightforwardly brought to heel by traditional human legal and political institutions." It will be like bitcoin, resistant to censorship.

There are economic benefits, too. Fees extracted from traders will be reinvested in DutchX’s operations, ensuring its success. Crucially, and unlike the previous DAO, revenue from running DutchX successfully will not flow back to the shareholders. “If one is looking at this from an investment perspective, it’s important to understand that the reputation being distributed via both staking and auction is non-transferrable and doesn’t entitle the holder to any cash flows or assets governed by the dxDAO,” said Shayne Coplan, who joined dxDAO after experiencing the promise—and pain—of the original DAO firsthand.

This supposedly keeps the dxDAO a blank slate upon which actual revenue-generating ideas can eventually be proposed, and voted in. “The whole point is that the members can vote in whatever,” said Coplan. “So they can, if they so choose to, make themselves money.” It might eventually present a way, he added, to run a token offering—an ICO, effectively‚ whose proceeds go to all DAO members collectively, which would be harder for the Securities and Exchange Commission to prosecute.

What makes dxDAO more exciting, said Coplan, is any protocol can co-opt its organizational structure. “There are endless possibilities in terms of adding new schemes and expanding the dxDAO’s horizons,” he said. “An intriguing example would be forking existing protocols and assigning the rights to adjust said protocol’s parameters to the dxDAO.”

So, imagine if a project like prediction market Augur went kaput—let’s say the non-profit Forecast Foundation that oversees the project’s development was sued by the SEC, and its employees were somehow prohibited from releasing updates to the Augur interface (as could happen). dxDAO could effectively commandeer the project by forking the code and assigning its development to its own decentralized network of participants, keeping it alive forever.

Holographic Consensus

One innovative way that dxDAO differs from the original DAO is in its use of prediction markets to zone in on proposals worth voting on. High-priority proposals, which can be submitted by any member, are first broached via “holographic consensus,” a mechanism that gauges member sentiment by having them place bets on whether a proposal will be accepted.

The “signal” generated by the prediction markets helps focus the masses on proposals that are worth voting on, according to an anonymous employee from Loopring, another decentralized exchange that’s invested $5 million in dxDAO. Gauging general sentiment in this way will also ward off the maneuvers of any “malicious subgroup” that may emerge and attempt to game the system, according to the Gnosis blog post. The previous DAO didn't have such a mechanism, and quickly became a discordant mess.

This allows governance to truly take place “on-chain,” as in ratified and mediated through code, via the Ethereum network. As the Loopring employee wrote in a series of tweets on May 29, this is “something decidedly detached from the #Ethereum base layer.”

Catch me if you can

The DutchX/dxDAO intersection also acts as a bulwark against the regulators. Most decentralized exchanges, such as Bancor and EtherDelta, are still run by a cohort of developers. In the case of EtherDelta, that resulted in a $400,000 fine, after the Securities and Exchange Commission alleged the exchange had been running as an “unregistered national securities exchange.”

But according to one DutchX developer, who indeed asked to remain unnamed, that can’t happen on an exchange run by hundreds of investors, mostly anonymous and based in different jurisdictions, spanning the globe.

The developers may have built and released the code for the DAO. But they are not operating it and have no responsibility for its day-to-day functionality, even though it potentially generates revenue. It’s… autonomous. “You want to make the argument that you are not running this exchange,” the source said.

True believers

DxDAO is still in its early stages. It’s roughly a week into its 30-day on-boarding trial, after which the DAO’s stewardship of DutchX will begin in earnest.

Maria Paula Fernandez, the communications director at Golem, became curious about the project several months ago. Last week, she put in two ether, worth at the time around $490. Golem, which builds decentralized software for distributing computing resources, originally planned to raise funds via the first DAO—subsequently becoming one of the first to run an ICO when it crashed.

For Fernandez, there are deeper, more philosophical ideas at play. DAOs, she said, represent a shift from traditional, more opaque hierarchies, toward a new model of human flourishing. “For me, it’s not about DAOs replacing institutions, but enabling global, fair, transparent and scalable coordination.”

Adult industry crypto camming platform Spankchain, too, is planning to join. The company’s CEO, Ameen Soleimani, is also the mind behind Moloch, another innovative DAO whose funding recently surpassed $1 million. Does Soleimani think this dxDAO stands a chance?

“Only one way to find out,” he said, cryptically. Blissful unpredictability, it seems, is part of the fun. Indeed, the dxDAO’s own pitch deck ends with the titillation, “We don’t know what a DAO can do yet.”

Still, other observers believe that dxDAO has enormous potential. Coplan, the investor who was involved in the original DAO, thinks dxDAO represents a chance to correct history.

“I participated in the original ‘theDAO’ sale and, because it failed so quickly, there are still a lot of unanswered questions in regards to the viability of collective governance of digitally-native organizations, particularly if they can make good decisions quickly,” he said. “The dxDAO has picked up some mindshare in the community and thus should have decent engagement, so it’s a ripe testing ground.”

Gnosis’s Koeppelmann, for his part, acknowledges there’s still a long way to go. “It’s risky,” he said. “But also fun.”

Update: An earlier version of this piece mistakenly described Golem as a "mining startup." It is not.