In brief

- Crypto exchanges are platforms for purchasing or trading cryptocurrency.

- Users can trade with digital currencies such as Bitcoin or Ethereum, or use more traditional fiat assets.

- Some of the leading crypto exchanges include Binance, Coinbase and Kraken.

In the wake of the much-ballyhooed public listing of Coinbase, the crypto exchange has arguably become the closest thing to a household name in cryptocurrency. But many crypto-newcomers have been asking the experts at Decrypt: What are my other options if I'm ready to buy some coin? Who are Coinbase's competitors?

We've put together a list of some of the leading crypto exchanges as a starting point. It's by no means comprehensive—there are literally hundreds of crypto exchanges, all serving different markets. Nor is it ranked in any way that represents a value judgment. What Decrypt has attempted to do is pull together a list of some of the leading exchanges out there, particularly for those new to the space.

Remember: Investing in crypto is still high-risk. You should only put in what you can afford to lose—if you choose to invest at all. Decrypt is not dispensing investment advice.

Before we soldier on, let's have a quick recap of what an exchange actually is. They’re platforms (web sites and, usually, mobile apps) that let users buy and/or sell cryptocurrency, either through trading for other digital currencies or using traditional fiat assets. Some exchanges accept deposits via credit card, bank account, or wire transfer, while others trade in crypto only. Some offer withdrawals to your own wallets, while others do not, and have varying arrays of coins, fees, and apps.

There are also more complicated exchanges that enable users to trade in crypto derivatives, or decentralized exchanges (DEXs) that offer peer-to-peer transactions between users with no intermediary.

With all that said, let’s take a look at some of the biggest names.

Coinbase

What is Coinbase?

One of the most well-known and widely used exchanges in the world, Coinbase was founded in 2012 and reached record highs at the end of 2020, with $89B in trading volume. Because it lets users purchase popular coins like Bitcoin and Ethereum with fiat, Coinbase is often the starting point for most people on their crypto journey. Coinbase itself is more of a brokerage that also offers a virtual wallet. For more experienced users, there’s Coinbase Pro, a more traditional exchange where users can trade with each other using more sophisticated tools such as limit and stop orders.

What coins can I buy on Coinbase?

Coinbase has a total of 75 cryptocurrencies available across its regular and Pro exchange. These include the likes of Bitcoin (BTC), Ethereum (ETH), XRP, DASH, DAI, Tether (USDT) and Dogecoin (DOGE).

The exchange also shies away from listing some privacy coins; Zcash (ZEC) is not available to trade for Coinbase users in the UK, while Monero (XMR) is unavailable in any region, with CEO Brian Armstrong stating that regulators are uncomfortable with the cryptocurrency.

Perhaps unsurprisingly, Coinbase also doesn't list rival exchange Binance's BNB cryptocurrency.

What are the fees like?

You can check out a full rundown of Coinbase and Coinbase Pro fees here and here, but here’s a summary of the fees in general.

- Wallet service: Hosting coins in your Coinbase wallet and transferring funds from one wallet to another is free.

- Buy/sell transactions: Coinbase charges a spread of around 0.50% for crypto purchases and sales. The actual spread might be a little higher or lower based on market fluctuations on Coinbase Pro. In addition, the company also charges a Coinbase Fee which is “the greater of (a) a flat fee or (b) a variable percentage fee determined by region, product feature, and payment type.” In general, the fees on regular Coinbase are regarded to be pretty high, which is the trade-off for beginners finding an easy on-ramp into the crypto world.

- Credit transactions: If you borrow USD from Coinbase or an affiliate and your BTC collateral is sold, you’ll be charged a flat fee of 2% of the total transaction.

- Variable fees: There are too many location-specific fees to list here, but in general, you’ll be subject to percentage fees on credit/debit card purchases, buying/selling, bank transfers and withdrawals. More detail can be found here.

How easy is it to use?

The regular flavor of Coinbase is one of the easiest ways for anyone to buy crypto, as it supports fiat purchases using your bank or card details. Coinbase Pro is slightly more complex in that you have to create sell/buy orders, but that’s bread and butter stuff for any exchange, and is one of the first things that neophyte traders learn. The fact that you can transfer assets from Coinbase to your Coinbase Pro account is another handy bonus.

Does it have an app?

Coinbase actually has three different apps, with different functions and target users in mind. Coinbase (for iOS and Android) lets you buy crypto with fiat, while storing them in an in-built wallet. Coinbase Pro, also available on iOS and Android, unlocks the more advanced trading options with buy/sell orders. Coinbase Wallet (available on, you guessed it, iOS and Android) is a third app that actually lets you possess your own coins, using your own private key. This is far better than storing your coins on an exchange wallet, and is always recommended.

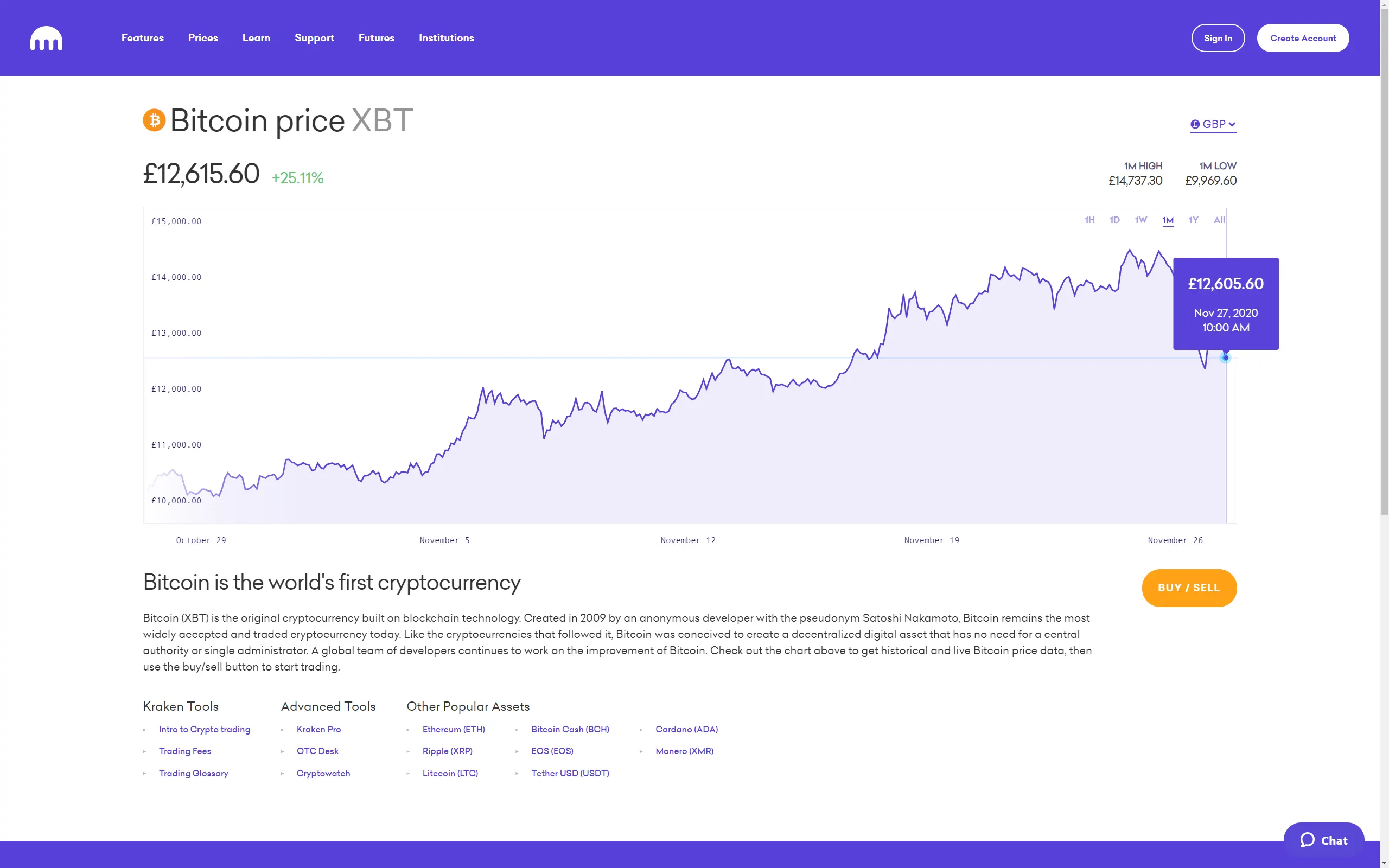

Kraken

What is Kraken?

Launched in 2013, Kraken is now one of the largest exchanges in the world—the fourth-largest in fact. Available in 48 US states and 176 countries, it was founded by crypto enthusiast Jesse Powell, who was prompted to create his own exchange after the infamous Mt. Gox security breach.

What coins can I buy on Kraken?

Kraken currently sells 77 cryptocurrencies, including BTC, DAI, AAVE, ETH, DASH, and DOGE. Decentraland players can also buy and sell MANA, if they so wish. Brave Browser users can also trade their earned BAT (or snap up some more). Notable coins that are missing from the exchange include Binance's BNB (spot a recurring theme?) and VeChain (VET).

What are the fees like?

Kraken charges fees for a number of different things. Here’s a general overview:

- Funding fees: Thereare fees in place for when you make deposits and withdrawals with both crypto and fiat. These range from 0.9% for stablecoins purchased using fiat or other stablecoins, to 1.5% for other crypto and FX pairs. There are also fees for payment card processing (3.75% + €0.25) along with an online banking processing fee of 0.5%.

- Trading fees: There are also the usual trading fees, which kick in when your order is executed (canceled orders have no fees). Fees range from 0-0.20% of the total value of your order and depend on the currency pair being traded, your 30-day trading volume in USD, and whether your order is maker or taker. There’s also a minimum trade fee.

- Margin fees: If you’re trading using leverage, you’ll be subject to margin opening and rollover fees

Kraken’s full set of fees can be found here.

How easy is it to use?

Kraken’s super-clean interface and layout make it one of the best-looking exchanges around. Beginners should find it less overwhelming than other offerings, with fewer charts, graphs and buttons cramming the screen. As with most other exchanges, you’ll need to provide some information and official ID if you want to do anything more than the most basic trades, but once you’ve passed KYC checks, everything is clearly laid out and explained.

Does it have an app?

Kraken offers iOS and Android apps which provide users with a finger-friendly mobile version of the exchange. Having said that, the app isn’t available in certain countries, including the US.

Gemini

What is Gemini?

Gemini is another US-based crypto exchange. Headquartered in New York City, it was founded in 2014 by Tyler and Cameron Winklevoss. In 2016 it became the world’s first licensed ETH exchange. It prides itself on its security measures, which include private keys, password protection, and storing only a small percentage of the exchange’s Bitcoin supply online, to reduce the risk of losses through hacking.

What coins can I buy on Gemini?

Gemini has a total of 68 coins available to trade at the time of writing. These include heavy hitters like BTC and ETH, as well as DAI, BAT, AAVE, Cardano (ADA), Uniswap (UNI), Litecoin (LTC) and more. As with a few other exchanges on this list though. The exchange recently added Dogecoin, though some notable coins are missing from the list, notably Monero, VeChain and (yet again) BNB.

What are the fees like?

Like other exchanges, Gemini funds itself through charging fees. It’s beyond the scope of this article to dive into the fine details (you can view those here), but here’s a general overview:

- Trader fees: Gemini uses a maker-taker fee model, and orders can be subject to both. If you place an order that’s partially filled straightaway, for example, you’ll be charged a taker fee on the filled portion. The remainder will be charged a maker fee when it’s filled. Interestingly, the trading fees are dependent on your volume in USD in 30-day periods. The more you trade, the lower the fees. All orders placed via the mobile app also have a varying convenience fee, and the same goes for desktop browsers too.

- Custody fees: Gemini charges an annual fee for storing your digital assets which, at the time of writing, is 0.4%.

- Transfer fees: Beyond trading fees, you’ll also have to pay the standard network fees for the likes of BTC and ETH deposits.

Gemini users around the world can now purchase #crypto with Apple Pay and Google Pay!🚀

Follow the easy steps on our blog to connect your debit card to Apple Pay or Google Pay⬇️https://t.co/6iVF1getkw

— Gemini (@Gemini) April 22, 2021

How easy is it to use?

Gemini is a clean-looking exchange, which makes navigation and use easy for beginners and pros alike. The signup process is relatively straightforward, and you’ll need to supply personal information like your name, address, email and more. You’ll also need to complete KYC (Know Your Customer) verification. Unlike other exchanges which accept things like driving licenses, Gemini will only accept valid passports. Proof of address requirements are less strict, and can include things like bills and bank statements.

Does it have an app?

Gemini has an app that puts the features of the exchange in a smartphone-friendly form factor. It’s available on both iOS and Android, and even the Samsung Galaxy Store too.

Binance

What is Binance?

Next to Coinbase, Binance is one of the most recognizable crypto exchanges around, and is the number one exchange in the world in terms of trading volume. Founded in China in 2017 by Changpeng “CZ” Zhao, the company moved its headquarters and servers from China to Japan ahead of China’s ban on crypto trading in 2017. Over the years its headquarters have moved, and it was, until early 2020, located in Malta. While it has lots of offices with staff in over 50 countries, its officially registered headquarters is now in the Cayman Islands.

What coins can I buy on Binance?

Binance lists hundreds of coins for users to trade, including BTC, ETH and LTC, along with, of course, its own native BNB tokens. The exchange is continuously growing its collection of listed coins too, and is often seen as the holy grail of exchanges for coins to get listed on, especially by enthusiastic coin communities. And yes, DOGE is also listed, as is Shiba Inu Coin (SHIB), which has found its way onto the exchange despite Binance CEO CZ describing it as "super high risk".

That's perhaps no surprise; Binance is adept at rapidly responding to emerging trends in crypto, and quickly listing the latest hot coin; one reason why its list of supported coins is so comprehensive.

What are the fees like?

Binance’s fees are some of the lowest in the industry, made possible, no doubt, by the fact that it’s the world’s largest exchange.

- Deposit fees: Deposits on Binance are completely free.

- Withdrawal fees: Binance’s withdrawal fees fluctuate and are automatically adjusted based on the current market.

- Trading fees: There are various trading fees, depending on what your use case is. Each trade carries a standard 0.1% fee if you don’t use BNB to pay your trading fees. Binance also uses a maker-taker structure, and offers different ways to lower the fees. You can, for example, buy Binance’s own BNB tokens to pay fees with a 35% discount. You can also refer friends to the exchange to snap up more discounts, and high-volume traders can level their account up for some VIP discounts too.

How easy is it to use?

The sheer size of Binance’s coin and trade offerings can be overwhelming for beginners. There’s a hell of a lot to take in, and it can be a bit confusing. Once you understand the basic concept of sell and buy orders though, it’s easy to use, though not quite as accessible as the regular version of Coinbase (which isn’t really a fully-fledged exchange anyway). Binance Academy is a useful resource for newbies to learn about crypto in general, as well as offering in-depth guides to all the trading options that Binance has to offer.

In 2021, regulators around the world turned their attention to Binance; the UK's FCA issued a warning that the exchange was not permitted to undertake "regulated activity" in the country, while Japan's FSA warned that Binance was operating without registering with the regulator. Italy's securities regulator also warned that Binance is "not authorized to provide investment services and activities in Italy."

While none of these actions amounts to a ban on trading using Binance, several payment channels to and from the exchange have been disrupted. UK banks including NatWest, Santander and Barclays have blocked fiat deposits to the exchange, while Binance has suspended SEPA Euro bank deposits. The Faster Payments service has also been disrupted. Practically, that means it's now difficult for many people to use Binance as a one-stop shop for buying, selling and trading crypto; instead they're forced to use the exchange purely for trading, making use of other channels to actually purchase or sell crypto with fiat currency.employ

Does it have an app?

Binance has both an iOS and Android app, both of which bring the functionality of the desktop site to your pocket. The app is highly rated across both platforms—just make sure you’re downloading the official one and not a dodgy copy, especially if you’re an Android user.

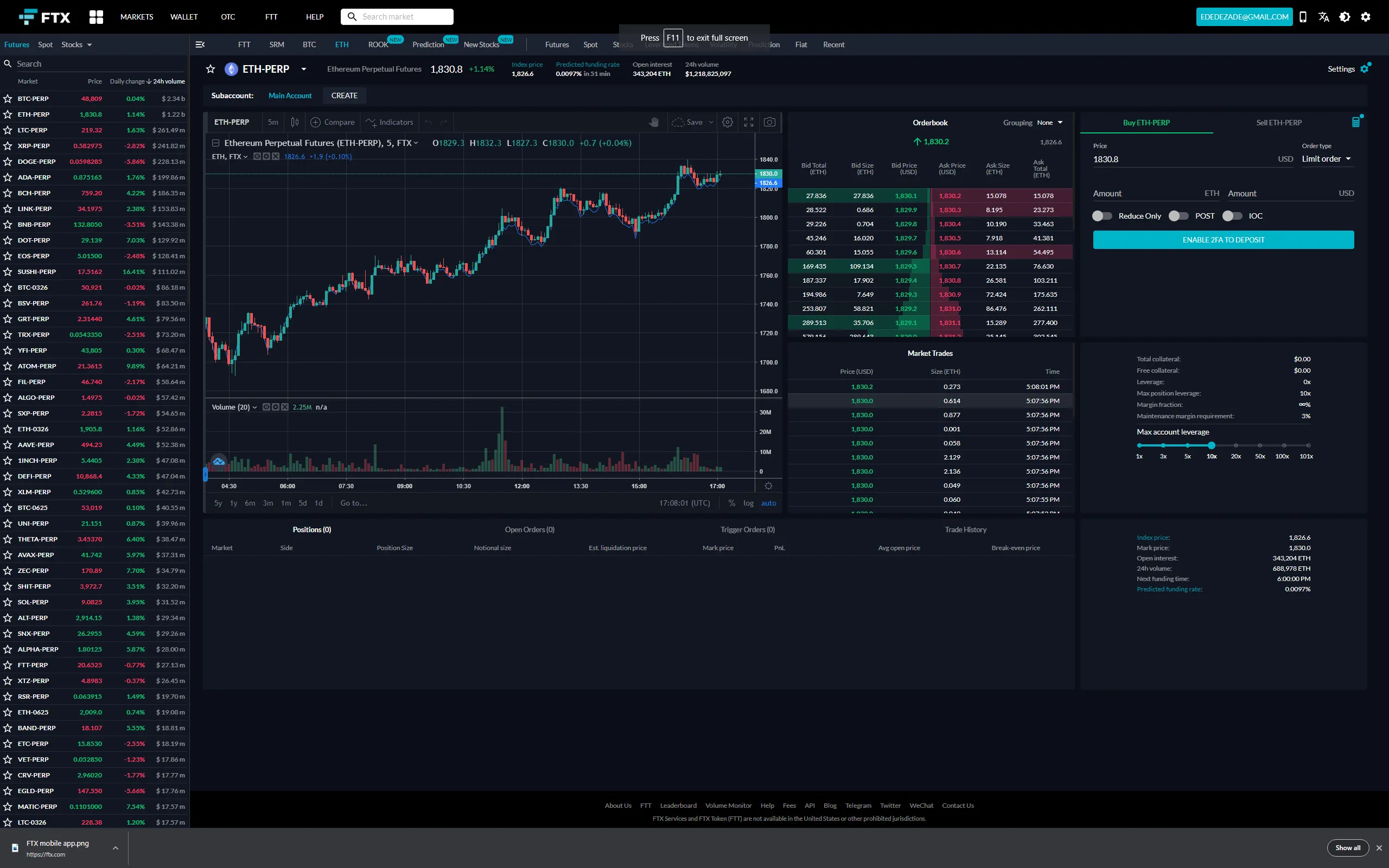

FTX

What is FTX?

Launched in May 2019, FTX is a relatively new entry, and is one of the top crypto derivatives exchanges in the world. This means it’s different from your traditional exchange in the sense that users can trade contracts on crypto assets, or buy tokens representing other assets or funds. One example are futures—investments which provide users with an obligation to buy or sell assets at an agreed future date.

What coins can I buy on FTX?

While FTX is primarily a derivatives exchange, it still offers a spot market (more traditional buying and selling orders). It currently offers just over 100 coins including BTC, BNB, UNI, ETH, BAT, and DOGE, with trading pairs including BTC, USDT, and AUD, EUR and USD. Exceptions on the spot trading market include XMR and VET, although they are supported in the futures market. In July 2021, FTX announced that it would limit users to a maximum leverage of 20x.

What are the fees like?

FTX has a tier-based fee structure that’s based on trading volumes in USD.

- Deposit fees: There are no deposit fees on FTX.

- Withdrawal fees: Withdrawals are also free, unless the withdrawal exceeds your trading volume, in which case there’s a 0.10% fee. BTC withdrawals over 0.01 BTC are free, while lower amounts are subject to fees, as are ETH, ERC-20 tokens, and Omni withdrawals.

- Trading fees: Most users will have maker fees of 0.02%, with taker fees at 0.07%. Higher volume traders will see these fees reduce. Other fees can also be found with leveraged tokens and redemption fees which are 0.01%, while users trading with a 50x or 100x leverage on futures contracts will see increased trading fees of 0.02% and 0.03%.

How easy is it to use?

FTX is a slick, polished exchange, but there are no two ways about it—if you’re a beginner then the options of futures, stocks, leveraged tokens, volatility and more will make for a very confusing and intimidating first impression. That’s not a knock against the exchange itself, it’s just that it’s aimed at experienced crypto users looking for something beyond simple trading.

Does it have an app?

The FTX app is available on iOS and Android, and offers a similarly smooth experience to the full-fat desktop website.

Crypto.com

What is Crypto.com?

Founded in 2016, Crypto.com was previously known as Monaco, but was rebranded one year later after the (expensive) acquisition of the crypto.com domain. While it’s best known for its Visa card, which allows users to convert their cryptocurrency and spend it anywhere that Visa is accepted, it also has other features—including an exchange.

What coins can I buy on Crypto.com?

Crypto.com has over 120 coins and tokens available to trade at the time of writing against USDT and the exchange’s own native token, CRO. BTC-tradable pairs are reduced to around 26 coins.

Exceptions include XMR, and while BNB is supported in some states, it’s not available in Alabama, Connecticut, Hawaii, Idaho, Louisiana, New Mexico, North Carolina, Vermont, Washington, Georgia, and Oregon.

What are the fees like?

As with a number of other exchanges, Crypto.com’s fees are volume-based, which means they decrease as your trading volume increases.

- Deposit fees: Deposit fees are free.

- Withdrawal fees: Withdrawal fees are subject to minimum withdrawal amounts, and vary depending on the asset. You can view the detailed list here.

- Trading fees: The highest fees are 0.10% for makers and 0.16% for takers. These drop all the way down to 0.04% and 0.10% respectively, although your trading volume will have to reach the lofty levels of $200,000,001 within a 30-day window. You can also choose to stake CRO and pay your trading fees in CRO, which nets you an additional 10% fee discount across all tiers.

We’re excited to share news of a historic moment:https://t.co/vCNztABJoG & @Visa successfully conducted the first settlement of transactions using USDC!

A huge milestone for the industry as crypto and fiat networks begin to converge.https://t.co/v70qC8n4Yy

— Crypto.com (@cryptocom) March 29, 2021

How easy is it to use?

The main exchange is easy to use for anyone who’s got to grips with basic trading options. The interface is clean and minimal, and should be easy to pick up. Things get more complicated if you click around and find the likes of derivatives trading of course, but that’s purely due to the experience required to find yourself at home there.

Does it have an app?

Crypto.com has apps on both iOS and Android which makes for a handy way to keep on top of trading, while also checking your Crypto.com card information, if you decide to sign up for one. If you do, you can get up to 8% cashback as well as earning interest on your crypto assets.

eToro

What is eToro?

Founded in 2007, eToro is an Israeli multi-asset brokerage company. It has offices registered around the world, including the UK, the US, Australia, and Cyprus. It added cryptocurrencies to its investment options in 2014, with a crypto wallet for Android and iOS launching in 2018. You can also use the site to trade stocks, currencies, and commodities.

What coins can I buy on eToro?

Currently, eToro lets you trade 28 coins, including BTC, ETH, LTC, DASH, XLM and BNB. That’s the lowest offering on this list, but we expect it to grow over the coming years. It's also recently added Dogecoin to its roster, though some key omissions include XMR, DOT and SUSHI.

What are the fees like?

The only trading fees eToro charges are for spreads.

- Trading fees: The fees for trading actually vary a fair amount depending on the coin. BTC fees are, for example, 0.75%, while BNB fees jump up to 2.45%. You can check out the full list of fees for the different crypto assets on offer here.

- Transfer fees: eToro users are subject to minimum withdrawal amounts and fees which vary depending on the asset in question. Again, the full list and further details can be found here. Deposits are free.

How easy is it to use?

eToro is fairly straightforward to use, and it also handily offers a free practice account. Registered users can play around with trading with a fake balance of $100,000, which is a great, unique way to get to grips with everything. Not only that, but you also have the option to copy other successful traders’ investments, with the obvious caveat that there are risks involved.

Does it have an app?

eToro has an app that’s available on both iOS and Android, with the Android app rating a little higher based on user feedback.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.