In brief

We do the research, you get the alpha!

$63,933.00

4.82%$3,081.21

3.83%$6.78

5.05%$553.71

5.28%$140.29

7.64%$0.99976

0.03%$3,075.23

3.76%$0.503686

4.22%$0.151019

2.34%$6.23

1.03%$0.459825

4.50%$0.00002275

5.16%$35.38

6.61%$63,892.00

4.73%$0.109364

-0.53%$485.77

6.93%$13.61

4.13%$0.689157

3.08%$5.81

9.01%$82.06

5.87%$12.63

8.01%$7.23

6.49%$5.84

-0.66%$9.57

5.64%$26.18

3.70%$1.15

3.59%$0.99991

-0.08%$2.44

9.06%$55.75

2.10%$0.124121

1.50%$6.01

4.77%$8.30

4.56%$0.110392

3.28%$473.03

4.36%$8.04

5.86%$1.16

5.11%$0.082437

6.74%$3,179.87

1.67%$0.0399161

5.44%$2.01

10.20%$0.1203

3.29%$2.57

9.79%$28.71

14.79%$0.254055

5.32%$0.99987

0.24%$2.25

4.93%$3,189.93

3.72%$0.00000516

3.25%$2.05

7.59%$116.39

-3.10%$2.08

7.00%$0.693594

3.62%$2.11

-2.01%$2.00

4.82%$10.00

-2.90%$3,402.06

2.85%$1.26

2.79%$0.04338775

10.58%$24.98

6.73%$1.25

-0.59%$4.77

0.72%$107.11

6.88%$3,165.90

4.42%$0.528681

6.41%$0.175604

5.64%$0.02702435

6.41%$0.00014011

5.56%$1.002

7.25%$9.39

2.71%$0.943722

1.58%$67.23

4.92%$0.881153

4.90%$18.53

5.98%$86.38

4.32%$0.0327375

5.04%$0.0245405

-12.30%$0.00000126

1.25%$3,077.17

3.51%$0.81369

4.52%$1.15

4.01%$13.88

3.20%$40.95

4.86%$0.850155

7.78%$0.598964

7.59%$2.21

9.21%$7.11

5.01%$0.00005128

3.88%$0.442542

5.35%$3.14

3.31%$0.00001476

5.65%$0.109269

1.13%$0.977358

2.51%$4.92

1.07%$2.87

4.27%$0.236831

5.38%$1.27

4.37%$3.98

9.28%$43.67

7.29%$0.604615

6.68%$0.02043696

-1.86%$15.88

2.39%$0.01844664

5.60%$6.65

1.01%$341.84

4.56%$0.799267

6.53%$0.756698

5.24%$166.39

8.52%$0.4388

5.17%$8.42

3.84%$1.25

7.81%$1.20

8.39%$3,100.45

2.85%$0.224509

6.03%$0.669309

6.70%$19.19

5.25%$1.75

12.77%$0.979811

0.17%$0.657997

5.78%$12.37

4.46%$4.23

2.65%$1.24

2.73%$2.77

5.68%$2.21

9.39%$3,073.01

3.43%$0.18562

6.92%$3,234.31

3.54%$0.997886

0.22%$164.33

8.07%$0.093776

6.31%$35.83

2.22%$0.392471

4.40%$3.69

3.87%$0.92154

2.11%$6.20

4.49%$0.00173417

0.04%$0.00010142

3.88%$2,382.92

-0.11%$91.66

6.04%$0.701711

1.59%$3,274.01

3.60%$0.067586

22.86%$0.00000027

7.56%$0.100375

6.21%$1.79

1.19%$0.085236

6.14%$0.053163

2.24%$0.28948

8.10%$0.876557

7.43%$1.49

3.92%$5.39

0.84%$0.0381198

4.18%$0.00935321

5.80%$0.433795

4.51%$1.003

0.85%$0.053542

3.86%$3,331.75

4.57%$0.095729

5.91%$0.38274

4.97%$0.328052

6.74%$0.00536186

-1.45%$0.40297

7.06%$0.238896

4.84%$0.441222

1.33%$1.84

-0.47%$1.079

8.92%$0.04509409

9.88%$0.00000045

0.85%$0.02438626

5.24%$0.985453

7.24%$2,392.38

-0.22%$0.815133

8.21%$0.0261203

2.35%$0.625718

19.21%$4.07

9.13%$0.502631

5.65%$13.60

5.98%$54.13

12.53%$0.611708

4.76%$3.62

4.61%$20.61

6.13%$0.00736381

3.07%$3.81

6.05%$1,281.69

3.88%$0.02975198

5.78%$0.560172

3.33%$0.0022689

6.61%$0.00707279

4.37%$1.53

5.87%$4.91

4.30%$0.51657

4.96%$0.823226

5.20%$11.95

6.27%$0.936169

6.01%$0.776455

10.10%$3,154.79

3.91%$53.97

6.09%$0.369023

6.60%$0.03078169

4.94%$3.50

-3.45%$0.246051

5.24%$0.02894291

12.03%$3.06

15.71%$1.68

14.37%$5.31

7.44%$28.84

6.67%$61.95

3.49%$8.26

4.24%$58.82

5.34%$20.57

4.29%$21.93

7.76%$0.03639173

6.20%$3.39

6.34%$0.03363995

5.11%$0.255404

5.87%$0.734267

2.74%$0.913145

5.38%$0.404786

8.30%$30.15

3.76%$3.42

-0.65%$0.338566

14.87%$3.58

-2.08%$1.25

9.11%$0.106286

5.31%$0.0057455

2.97%$0.03233518

1.42%$0.785732

9.63%$31.44

4.33%$0.27229

-0.25%$28.94

6.00%$25.58

-14.94%$0.411915

16.60%$40.34

7.12%$3.72

4.30%$2.31

5.24%$0.307294

5.92%$63.75

5.14%$0.831318

2.70%$14.61

3.49%$0.157094

1.83%$36.36

3.43%$0.00000034

10.45%$0.00341584

6.42%$24.30

3.01%$0.820289

1.27%$0.02061183

9.87%$0.276176

5.22%$0.372857

10.85%$0.287336

5.58%

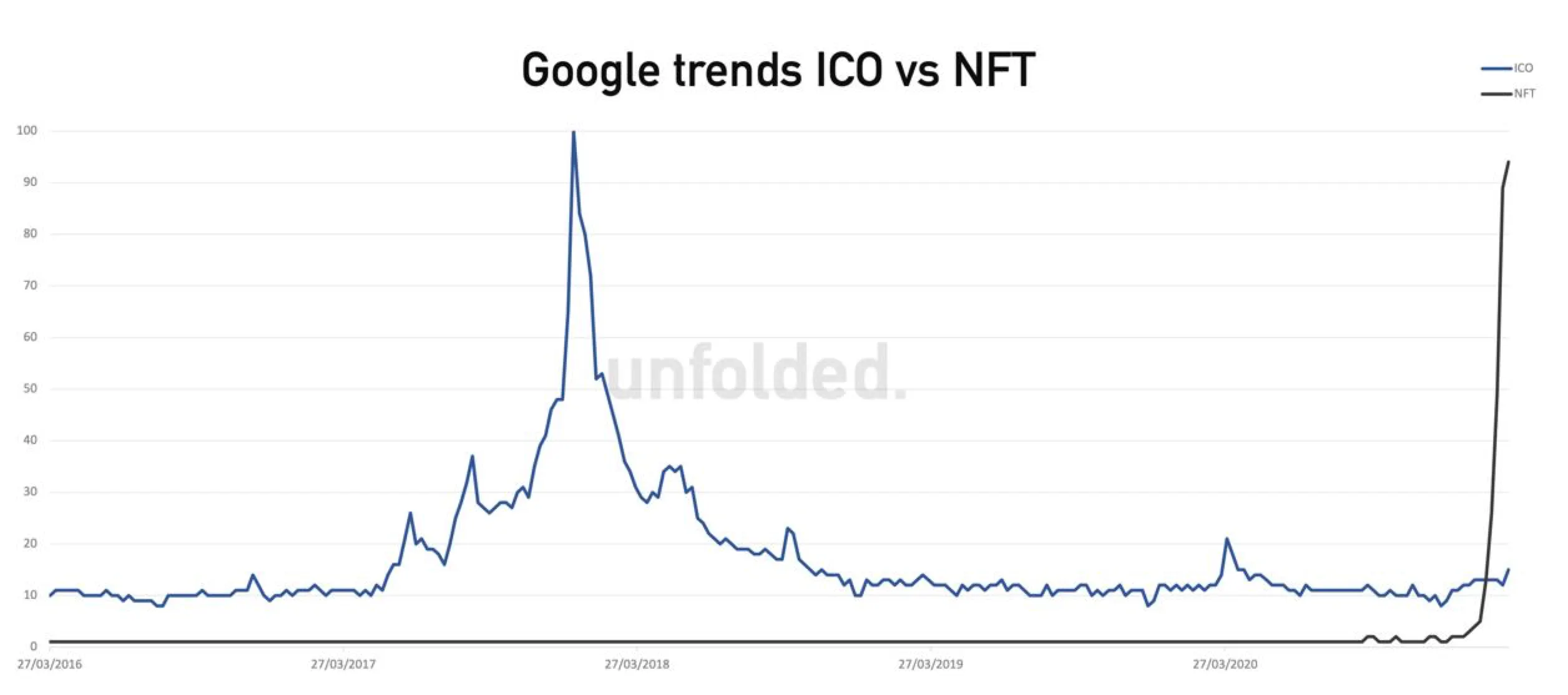

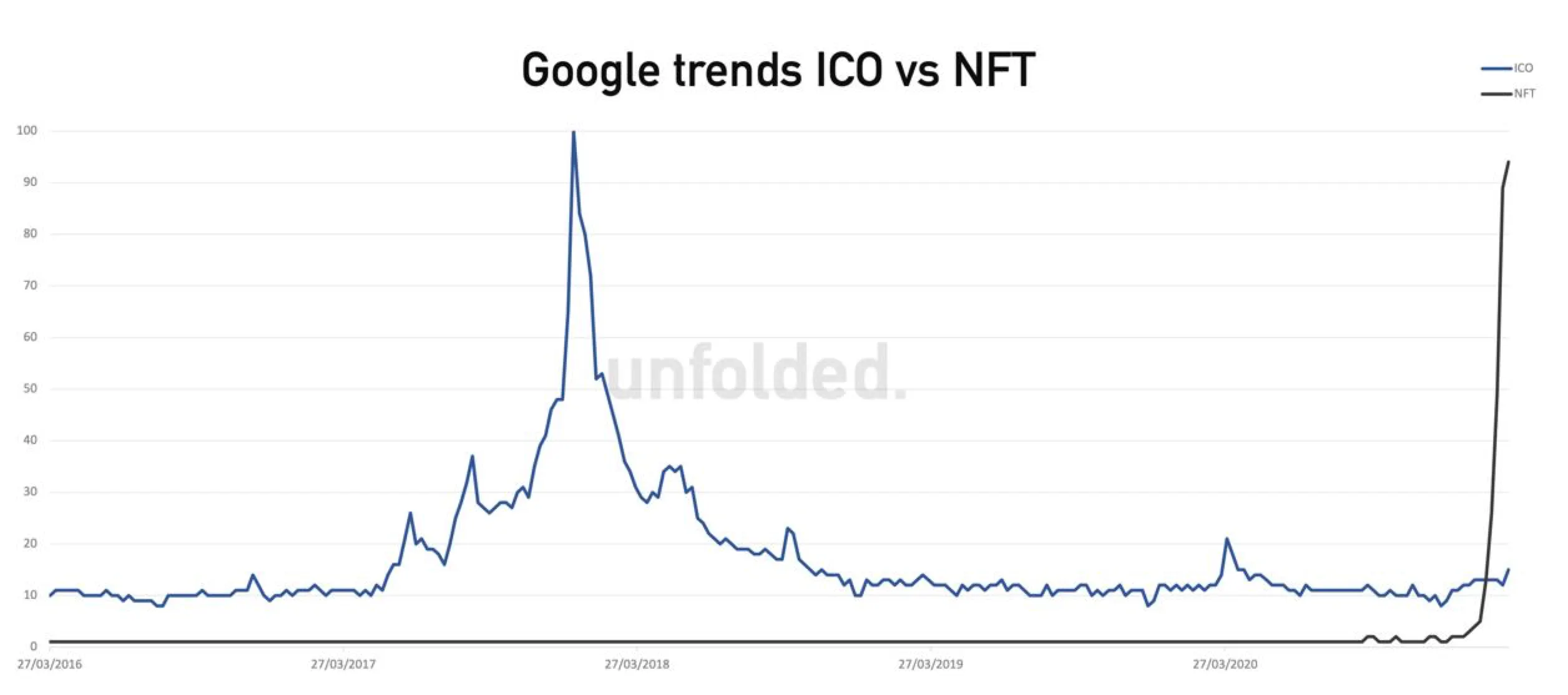

Interest in non-fungible tokens (NFTs) has reached almost the same level as interest in ICOs in 2017, according to Google Trends data shared by Unfolded, a crypto analytics website.

As the above graph shows, ICOs, or initial coin offerings, surged in popularity in the second half of 2017, alongside Bitcoin's bull run to an all-time high price of just under $20,000. As Bitcoin’s price collapsed in early 2018, so too did interest in ICOs—as reflected by Google search volume.

NFTs, cryptographically-unique tokens that can be used to represent media such as artwork and music, shot to prominence in 2020 and 2021 amid a series of high-profile digital art sales. Digital artist Beeple sold one NFT at auction for a record-breaking $69 million—making it the third most expensive artwork by a living artist—while celebrities and artists flocked to create their own NFTs.

That rise in interest is mirrored in Google Trends search data for NFTs, which has visibly shot up and is almost a vertical line in 2021.

An ICO is an initial coin offering—a type of crowdfunding that uses cryptocurrencies. During Bitcoin’s 2017 bull run, investors poured approximately $22 billion into ICOs; many either failed to live up to their hype, or failed completely.

In addition, the US Securities and Exchange Commission cracked down on a number of ICOs, claiming that they had conducted unregistered securities sales. Since then, the mania for ICOs has cooled somewhat—and NFTs appear to have seized the limelight.