In brief

- Crypto markets record back to back gains as recovery continues.

- US markets continue to worry about the sudden surge in bond yields.

- The confidence is causing a negative effect on growth stocks.

We do the research, you get the alpha!

Over the last few months, crypto and Wall Street have been moving in unison as investors from the world of big finance add digital currencies to their portfolios. But overnight a riff opened up between the two.

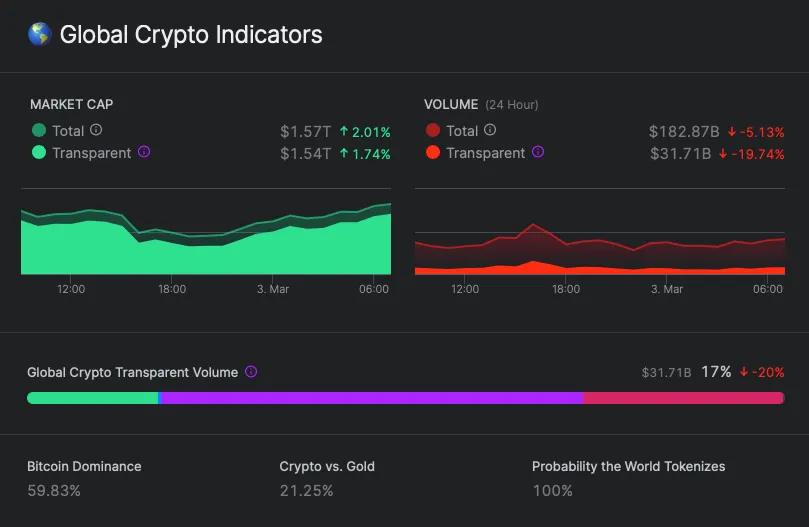

Global crypto market cap added another impressive 3% to sit comfortably in the $1.5-$1.6 trillion range. The back to back gains this week have helped markets recover most of the losses suffered last week, according to data compiled by Nomics.

Bitcoin continued its slow and steady march back to $1 trillion with a 3.7% gain. Ethereum is heading towards the $1,600 mark with a 2.39% increase in price yesterday. It was a fairly quiet day all in all for the big cap projects, but the midcap currencies - projects valued between $10-$40 billion - saw a flurry of activity.

Polkadot pushed Tether out of the top 5 biggest projects after a 6% rise and Litecoin jumped 11% after news emerged that Grayscale Investments had bought 80% of all the mined LTC in the last month.

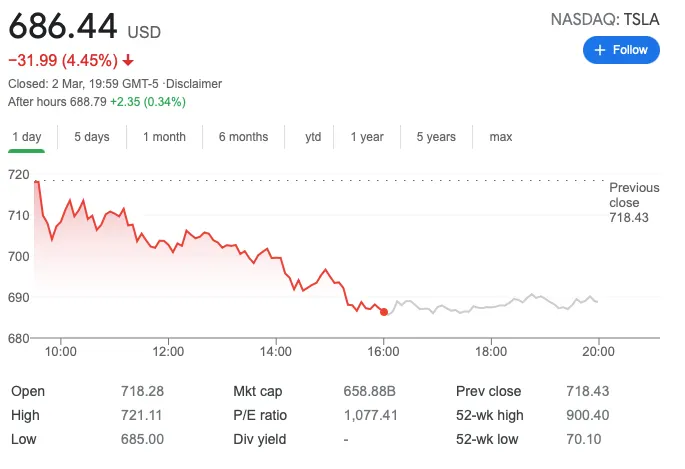

Over in Wall Street meanwhile, the S&P 500, Dow and the Nasdaq all closed down, with futures markets following suit.

Tech stocks sank the Nasdaq as again, investors went in search of companies that set to benefit most from the restart of the US economy, most noticeably airlines and hospitality.

But the spectre of rising inflationary pressure is looming over investors once more. As the Federal Reserve reiterated its long-term support of the economy with continued bond-buying, there’s a nagging feeling that things aren’t as rosy as they seem. And there’s some evidence for that.

The $21 trillion US Treasury bond market is meant to be the stable bedrock of global finance, setting the benchmark risk-free rate for much of the world.

But last week’s sudden surge in yields was unusual, and history buffs have been looking closely to see if it bore the same hallmarks as previous sudden swings.

In recent memory, the crash of March 2020, the 12-minute crash of October 2014 and the financial crisis of 2008 all saw similar swings, but the reasons for each one were slightly different.

In the most recent swing, when Covid finally hit the markets, it was caused by a raft of panic selling after hedge funds’ become over-exposed to plummeting prices. Because no clear picture has emerged over what happened last week, it’s left investors feeling unsure if they should commit to further spending in equity markets, or hold on to their cash and wait and see.

For those willing to buy stocks, money is pouring into companies who are set to grow as the economy reopens. For those not willing to spend, their absence could amplify the already choppy market conditions.

Sponsored post by AAX

Learn More about partnering with Decrypt.