In brief

- Coinbase's S-1 filing showed the crypto exchange made over $300 million in profit last year.

- It also illustrated how Coinbase's bumper year played out against the backdrop of Bitcoin's 2020 bull run.

We do the research, you get the alpha!

The recent S-1 filing by Coinbase gives a detailed insight into the financial health of the cryptocurrency giant—and how it’s played out against the backdrop of Bitcoin’s recent bull run.

Coinbase’s balance sheet showed a profit of $322 million for 2020—a sharp reversal of fortune from the previous year, when the cryptocurrency exchange closed 2019 with losses of $30 million. Much of Coinbase’s dramatic turnaround over the last year can be attributed to Bitcoin’s dramatic 2020 bull run, which saw the cryptocurrency increase by over 300%.

2020 saw institutional investors such as MicroStrategy and Square flock to Bitcoin, explained Tim Rainey, CFO of Greenidge Generation. “For institutional service providers in the industry, including exchanges, it was a busy year.”

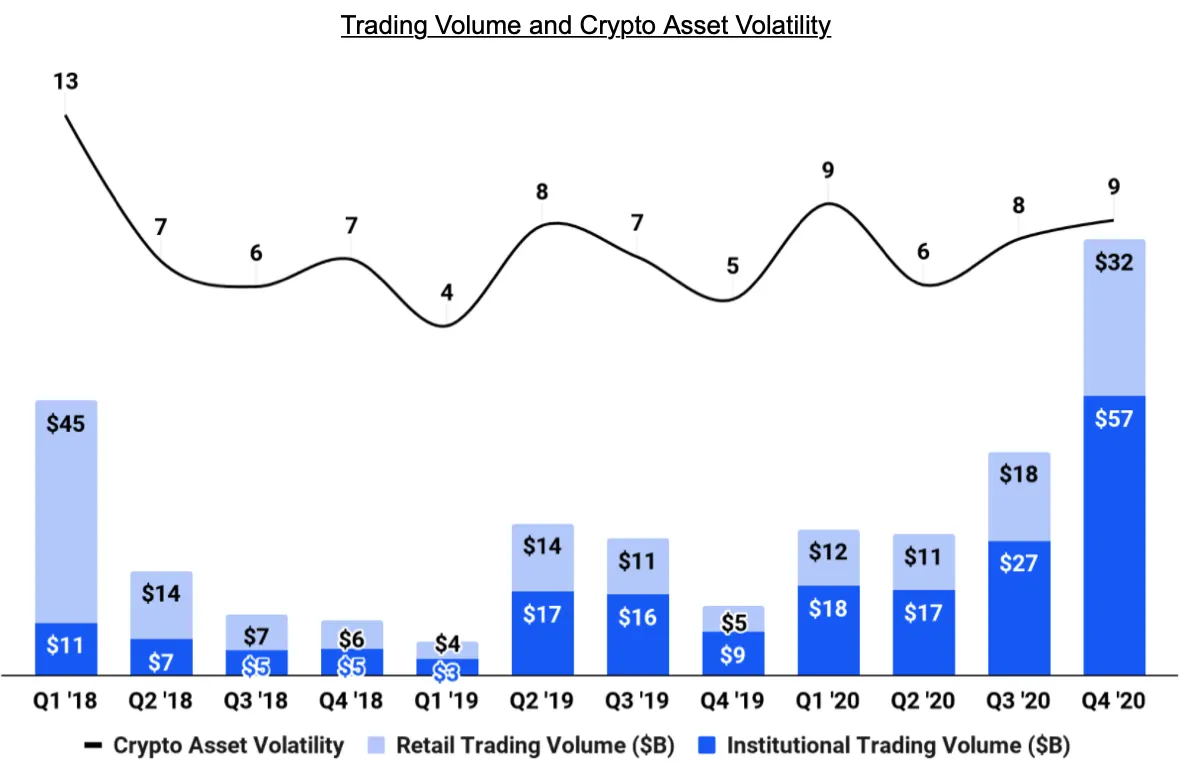

That’s borne out by the numbers in Coinbase’s S-1 filing. In a chart labeled “Trading Volume and Crypto Asset Volatility,” Coinbase has documented the rise of trading volume for both institutional and retail Bitcoin investors.

According to the S-1 filing, retail trading volume for Q4 2020 was $32 billion, and institutional trading volume for Q4 2020 was $57 billion. At the start of the year, these figures were $12 billion and $18 billion, representing percentage increases of 166% and 216% respectively.

Much like Bitcoin, these trading volumes increased rapidly for Coinbase throughout all of 2020.

Bitcoin began last year at a price of approximately $7,200, and after dipping to about $4,000 in March, steadily increased to over $11,000 by August. By then, Coinbase’s retail and institutional trading volumes had both increased 50%. By August, Coinbase’s trading volume had seen a significant increase, but the company was about to benefit immensely from a new wave of institutional investment that began that summer.

A year of institutional investment in Bitcoin

The influx of institutional investment was sparked by business intelligence firm MicroStrategy, which first invested in Bitcoin in August and September of last year, spending $425 million. By November, this investment was worth over half a billion dollars. Throughout 2020 and 2021, MicroStrategy has continued to invest in Bitcoin, bringing its total holdings up to $4.5 billion.

It was soon followed by others, including Square and EV manufacturer Tesla, which sent Bitcoin’s price spiraling upwards to a new all-time high following its $1.5 billion investment in Bitcoin.

Coinbase was selected as the primary execution partner to initiate MicroStrategy’s purchase of bitcoin. Read more here: https://t.co/8iRqselOuP

— Coinbase Pro (@CoinbasePro) December 1, 2020

Coinbase has played its part in facilitating institutional investment in Bitcoin, facilitating MicroStrategy’s Bitcoin buy. Back in 2018, it opened an over-the-counter trading desk, enabling organizations and high-net-worth individuals to trade large amounts of BTC. Since then, it’s been suggested that large Bitcoin outflows from the exchange are likely OTC trades made by institutional investors.

That trend looks set to continue; just yesterday, an outflow of 13,000 BTC—worth some $470 million—was transferred from Coinbase, implying that institutional investors are still bullish on the flagship cryptocurrency.

Retail investors played a part, too

However, Coinbase’s gains can’t be wholly attributed to big companies like MicroStrategy and Tesla. Retail investors have driven a lot of this growth themselves.

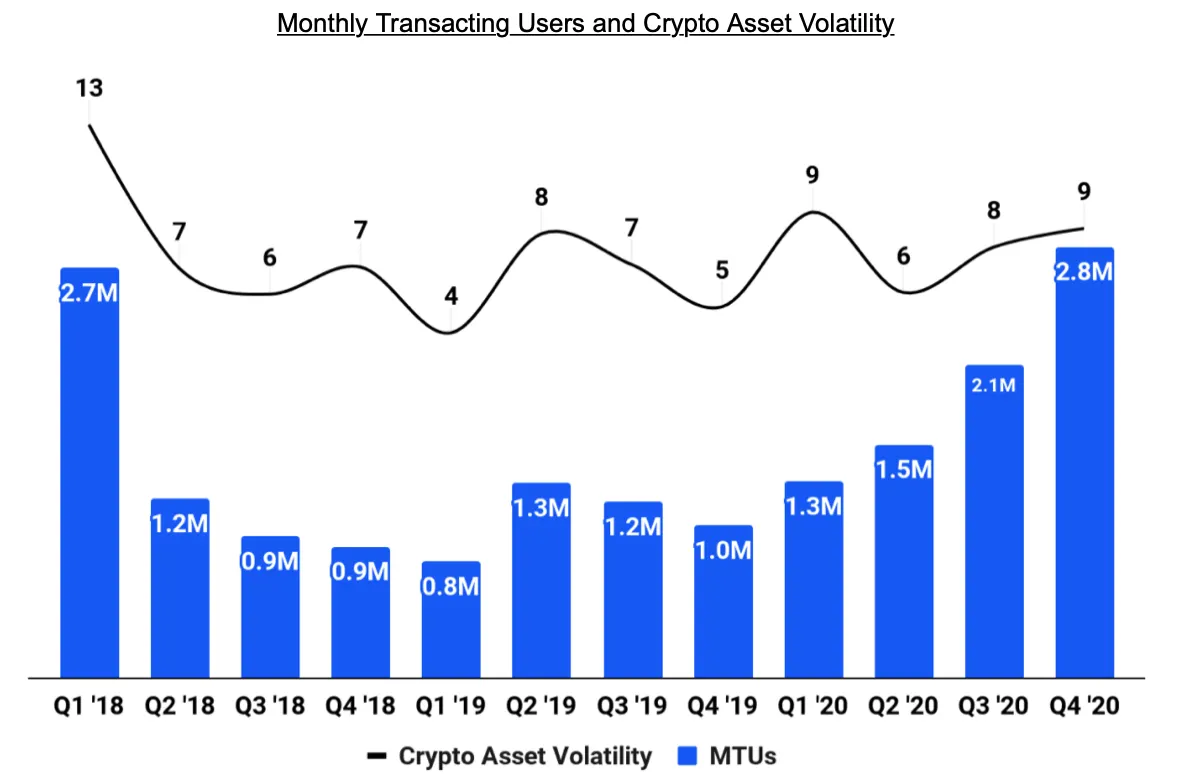

The above chart shows Coinbase’s total number of monthly transacting users. During 2020, this total grew from 1.3 million to 2.8 million, an increase of 115%. While institutional investors poured a lot of money into Bitcoin in 2020, the majority of these users are regular retail investors, who’ve flocked to a cryptocurrency that ended 2020 over four times as valuable as it started the year.

"From first-hand accounts of activity seen here in Asia, coupled with the retail-related data from Coinbase's S-1 today, the interest in cryptocurrencies and crypto assets is real and organic,” Standard Hashrate Group CEO Alex Zhao told Decrypt.

Indeed, in the UK alone, financial comparison site finder.com has tracked a 558% rise in cryptocurrency investors since 2018, with a quarter of respondents saying they first bought cryptocurrency in 2020.