In brief

- The Binance Card is a Visa debit card enabling users to draw on their Binance crypto holdings.

- It converts crypto into fiat at the point of sale.

- Binance Card supports payment using Bitcoin, Binance Coin, Ethereum, SXP and BUSD.

In the last year, crypto debit cards have taken off in a big way, with numerous exchanges launching cards that variously let you pay with crypto, or offer crypto rewards.

Now Binance, the world's largest crypto exchange, has joined the fray. But is its new Binance Card the gateway to crypto that it promises to be? We put it through its paces.

What is the Binance Card?

The Binance Card is, perhaps unsurprisingly, a crypto debit card launched by Binance. Announced last March following the exchange’s acquisition of crypto debit card company Swipe, the Binance Card was released in select European countries in September 2020.

The card supports payments with Bitcoin (BTC), Binance Coin (BNB), Ethereum (ETH), Swipe’s SXP token, and its own stablecoin, Binance USD (BUSD).

Crypto holdings are converted to fiat currency in real-time at the time of transaction; you also have the option of topping up your Binance fiat wallet with your default fiat currency and drawing on that.

As a Visa debit card, the Binance Card can be used at over 60 million merchants across 200 regions and territories around the world.

When announced, Binance CEO Changpeng Zhao, more commonly known as CZ, stated that “Giving users the ability to convert and spend their crypto directly with merchants around the world, will make the crypto experience more seamless and applicable.”

That all sounds like it makes sense, right? A fancy card from a top exchange, spreading crypto to the masses in an easily accessible way — what’s not to love?

We spent some time diving into the Binance Card to see what the process is like, and what it brings to the table. Read on for our full review...

How easy is it to apply for?

Applying for the Binance Card begins by ordering one online directly from Binance. At the time of writing, the Binance card is currently supported in selected European countries, including Austria, Belgium, Ireland, Malta, Slovenia, and more (the full list can be found here). Crypto fans in the UK who were originally on the list of supported countries can pre-order, but are currently absent from the official list, presumably due to the rather messy business of Brexit. We’ve reached out to Binance for confirmation and will update this article accordingly.

If you don’t already have a Binance account you’ll have to create one first, which is as straightforward as providing your email address and personal details. It is, however, worth pointing out that you can only apply for a Binance card if your account is KYC level 2 verified.

Short for Know Your Customer/Client, KYC is a procedure used in financial services to help verify the identity of individuals. In other words, it helps prove to Binance that you are who you say you are.

To achieve KYC level 2 on Binance, you’ll need to upload a form of valid ID, such as a passport or driver’s license, along with proof of address verification, such as a utility bill. This might seem scary to crypto beginners, but rest assured it’s totally normal practice, especially on an exchange that’s as respected as Binance.

Uploading these documents can be done by hovering over your profile button in the top right corner, and selecting ‘Identification’. Once that’s done, you’ll want to ensure that you take a clear picture of your chosen ID, as well as a passport-like photo of yourself. You also need to ensure that the address on your utility bill or other document matches the address you type into the online form. While the length of time it takes to verify both your ID and address varies, we were pleasantly surprised that both fields were verified in less than an hour.

Physical #Binance cards have started shipping! 💳

Get your card➡️ https://t.co/aUUlTYfMha pic.twitter.com/lh2OfuHtb5

— Binance (@binance) December 15, 2020

Once you’ve reached KYC level 2, you can order your card here, by clicking on, you guessed it, Order Card. Follow the on-screen prompts to complete your order, and if successful, you’ll be issued with a virtual card immediately, while your physical card will arrive at a later date. At the time of writing, it’s unclear how long you’ll have to wait to receive the physical card due to high demand.

When you do receive your card, head on over to the Card Wallet section on Binance and hit the Activate button. From here you’ll need to enter the CVV number on the back of the physical card, and your four-digit pin code will then be shown. If you don’t activate your card within 45 days after ordering, it will automatically deactivate.

Design

As much as we’d love to say that the Binance Card is crafted from exotic materials like titanium or meteorite, we’re dealing with the same sort of card you’ve used all your life, albeit one with flat (as opposed to embossed) characters, presumably for longevity.

There’s currently no option to customize the card or stamp any of your own personality on it, which is bad news for meme lovers. For everyone else though, there’s little to complain about. The all-black and silver monochrome color palette has an air of sophistication about it, with nothing but some text and the ultra-minimal Binance logo to draw the eye. If Darth Vader had a debit card, it would look fairly close to this.

Setting up the Binance Card

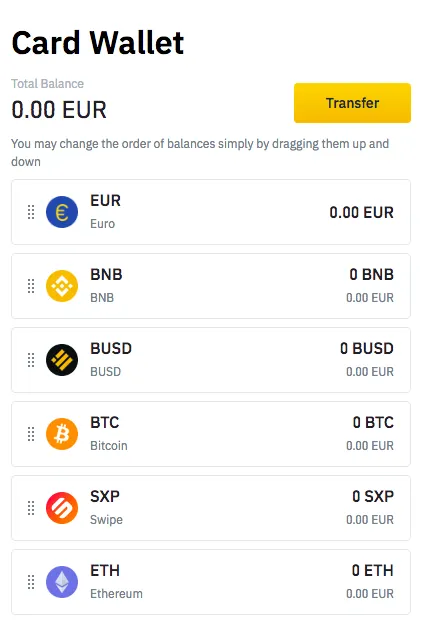

Once you’ve got your virtual and/or physical card set up and ready to go, you’ll want to familiarise yourself with how the card actually works. The most important thing you’ll need to understand is that the card doesn’t automatically pull in funds from your Binance crypto holdings balance.

To use the card, you’ll first have to transfer money from your Spot Wallet (the default Binance wallet which stores your holdings and allows you to deposit and withdraw funds), to your separate Card Wallet. You can choose to transfer fiat and other supported crypto over to your Card Wallet, and select the order in which funds should be debited first. If you’ve listed Euros and BNB as the top two funds, for example, the card will debit your Euro balance, before moving on to BNB once the Euros are used up.

The Card Wallet is best thought of as a supplementary place for your holdings to live. Shifting funds over might seem like an unnecessary step for some, but it provides the option to limit how much is on the card, in the event that it’s lost or stolen. The ability to prioritize which holdings are spent first is also a nice touch.

Once you’ve put your Card Wallet in order, you can spend it anywhere online or in-person that accepts Visa. Just make sure you’ve taken the time to top up the Card Wallet with funds from your main Binance wallet, otherwise your payment will be declined, and you’ll find yourself explaining your mishap to a very confused grocery store cashier. To save yourself the headache, you have the handy option to enable auto top-up, setting a minimal balance that’s automatically topped up without you having to worry about it.

It’s also worth noting that Google Pay and Samsung Pay users can set up their card by entering their card details in their choice of app, letting them make contactless NFC payments with Binance funds up to set limits.

Perks and fees

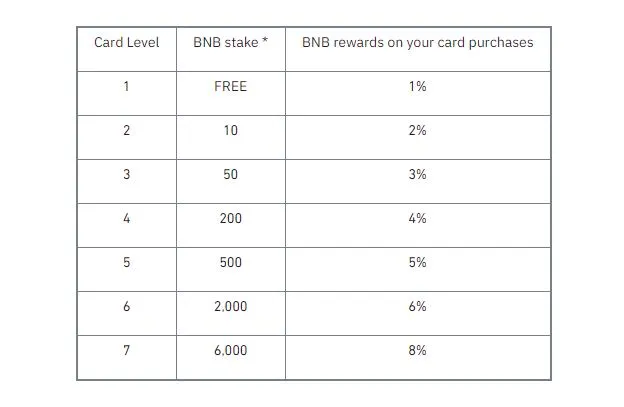

One of the main draws of the Binance Card is its cashback system, which rewards your account with up to 8% cashback on eligible purchases. The cashback is in BNB, and the amount rewarded depends on how much BNB you’re currently holding on Binance. The breakdown of cashback rewards can be seen below:

You can see your cashback transactions in the cashback vault, all of which will be one of three statuses; Pending, which means they’re calculated but not yet in your wallet, Completed which means they've already been sent to your Spot Wallet, and Declined, which means the transaction was not eligible for cashback.

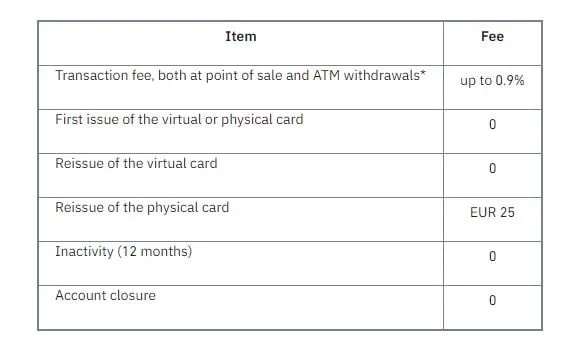

The cashback itself is awarded on a monthly basis, while some competitors offer weekly rewards. It’s also worth pointing out that the cashback percentage is based on your average holdings of BNB over the past month. This is disappointing, as it essentially means you have to wait and hold BNB for a whole month to unlock higher reward rates. On a more positive note, beyond the initial $15 issuance fee for the card itself, there are zero fees for monthly or annual card maintenance, which is a welcome bonus.

In terms of card limits, the virtual card currently has a daily spending limit of EUR 870, with a much higher limit of EUR 8,700 for the physical card. The daily ATM limit is capped at EUR 290. Additional fees for reissuing the physical card and for transaction fees, are shown below:

Is Binance Card worth using?

To reach the full 8% cashback reward on your purchases, you’ll need to have a minimum of 6,000 BNB in your Binance Wallet. At the time of writing, that’s just under $250,000 worth of BNB. Card level two, which unlocks 2% cashback, requires a more manageable stake of 10 BNB, or around $420.

These aren’t exactly friendly amounts for beginners dipping their toes into the crypto world for the very first time, but at least there’s still a 1% minimum cashback offer for people to benefit from using the card without forking out hundreds of dollars on BNB.

Picking up some #BNBreakfast.

Get your card here ➡️ https://t.co/hRhC3bRb0u pic.twitter.com/ZiCCyElHIA

— Binance (@binance) December 5, 2020

What is disappointing is the fact that the cashback rewards are tied only to BNB, which means someone with thousands of dollars worth of BTC, for example, won’t see any rewards.

If you’re heavily invested and committed to BNB, then the rewards appear to be worth it. It sounds niche, but so is the very concept of a crypto debit card tied to an exchange.

Verdict

There’s a simple case to be made for the fact that the Binance Card doesn't really need to exist. We don’t mean that in a harsh way. It is, after all, a slick card that integrates with the world’s biggest crypto exchange, and lets you use your holdings online and in the real world, making the blockchain more tangible and useful in everyday life.

The trouble is, you’re not ultimately paying for things with crypto. Your holdings are converted to fiat, so as far as the merchant is concerned, you’re just another normal user paying with ‘proper money’. This sort of goes against the whole ethos of being a crypto enthusiast, don’t you think?

The dream, of course, is for crypto to be natively accepted by merchants and shops at a fundamental level, with no middleman converting messing up the purity of it. That’s an adoption problem that not even the gargantuan exchange Binance can solve, so this card should at least be applauded for aiming for a transitional middle ground while increasing awareness of what’s possible with crypto.

Still, we’d only really recommend it for hardcore BNB fans looking to fill out their bags with the cashback rewards. Having said that, there’s no harm in nabbing one for yourself, especially with the lack of monthly fees. After all, one of crypto’s biggest draws is trying new things and pushing horizons. Perhaps cards like this are an important step to true mass adoption.

Rating: 4/5