In brief

We do the research, you get the alpha!

$64,516.00

5.60%$3,083.52

3.77%$6.73

3.46%$554.31

2.21%$143.44

10.61%$0.999762

0.03%$3,079.89

3.93%$0.4951

1.25%$6.94

18.13%$0.151876

5.89%$0.455701

3.84%$35.30

6.09%$0.00002263

4.74%$64,552.00

5.72%$0.108276

-0.85%$480.13

2.46%$13.66

5.87%$0.671539

2.33%$13.15

11.33%$5.72

6.29%$80.71

2.06%$7.48

8.99%$5.83

-0.37%$9.41

4.70%$26.15

3.95%$1.15

3.78%$1.001

0.59%$2.44

7.78%$55.22

1.89%$6.08

5.31%$0.12225

2.21%$8.27

3.58%$0.111419

4.60%$3,109.71

3.86%$465.72

5.86%$1.15

2.79%$7.90

5.10%$2.06

10.79%$0.082662

6.18%$0.04070073

9.31%$3,011.91

-2.92%$0.117403

2.08%$2.69

16.60%$27.87

11.10%$0.257449

8.85%$1.003

0.36%$2.23

3.51%$3,190.76

3.79%$0.00000515

8.47%$2.07

8.21%$116.72

2.66%$2.07

5.18%$11.24

19.28%$0.701434

8.42%$2.02

6.76%$1.26

-3.72%$3,405.28

3.92%$1.98

-0.22%$0.04545353

14.25%$5.07

15.23%$25.61

7.96%$1.26

3.48%$107.42

6.98%$3,165.88

4.50%$0.530807

9.54%$0.02691444

6.11%$0.175542

6.78%$1.042

13.53%$9.50

0.58%$0.00014008

8.03%$19.16

16.34%$0.937601

13.49%$0.882055

5.52%$66.86

4.61%$86.84

4.71%$0.00000126

2.81%$0.03154518

1.04%$3,070.11

3.30%$2.28

9.03%$0.781718

4.15%$13.84

2.77%$40.95

4.04%$0.854649

7.83%$0.02140615

-13.07%$0.592999

9.56%$1.04

-7.39%$7.08

3.91%$0.00005073

4.74%$0.44262

5.27%$3.14

3.26%$0.00001476

7.95%$0.107762

-0.33%$0.977544

5.21%$2.91

7.08%$4.88

4.09%$6.85

4.08%$0.607534

8.83%$0.22926

2.64%$1.24

3.84%$15.97

3.07%$43.06

4.74%$0.01850223

5.31%$3.84

2.30%$342.30

5.76%$0.02021398

1.78%$0.770177

6.89%$171.61

11.04%$0.7961

5.44%$8.42

3.54%$0.437767

4.95%$1.25

5.58%$1.21

5.64%$3,106.28

3.75%$0.226315

5.54%$0.674435

6.65%$12.59

5.53%$0.984463

1.17%$2.28

9.03%$18.53

5.01%$2.80

4.92%$3,079.47

3.64%$0.627467

1.13%$0.187498

6.50%$1.64

5.85%$1.20

1.47%$4.07

0.89%$3,233.92

3.65%$170.54

10.92%$0.097396

9.59%$1.001

0.40%$35.26

2.89%$3.71

5.57%$0.393928

7.57%$0.927272

3.12%$93.87

9.00%$0.00174048

3.24%$2,388.94

0.38%$0.00010121

4.25%$0.721749

7.58%$3,276.79

3.75%$5.93

0.12%$0.101395

6.06%$0.04019967

9.24%$0.085979

5.42%$0.00000027

6.79%$1.79

0.56%$0.053073

3.93%$0.292272

6.69%$0.063553

8.05%$0.757711

36.59%$5.36

0.76%$0.870224

6.77%$1.46

0.87%$0.437314

3.87%$0.00585675

28.58%$0.054034

7.39%$0.00929965

7.60%$1.001

0.28%$3,329.94

4.18%$0.421653

11.55%$0.331993

5.80%$0.380058

6.67%$0.092023

3.90%$0.445181

8.13%$1.83

4.44%$0.04591818

10.21%$1.019

10.45%$0.237155

5.35%$1.098

9.61%$0.02484319

8.60%$0.00000045

0.59%$2,407.17

0.55%$0.518193

8.98%$4.16

15.35%$0.02603491

7.10%$13.72

4.86%$0.802218

5.26%$21.07

7.02%$0.612931

4.97%$3.89

8.81%$1,294.44

6.02%$0.03021577

7.94%$53.12

11.59%$0.00735238

2.74%$0.566869

3.25%$13.03

14.83%$3.55

5.90%$0.00229572

7.81%$3.51

29.55%$1.54

8.48%$5.04

6.12%$0.00698368

2.11%$0.519286

5.77%$0.03048754

28.14%$0.775048

8.03%$0.819605

5.52%$3,157.49

3.72%$54.65

5.83%$0.249114

7.31%$0.915136

3.58%$0.369738

7.60%$3.52

3.56%$0.03083444

4.89%$5.61

14.47%$1.70

12.45%$0.387257

39.23%$61.69

9.89%$29.41

6.93%$22.45

9.12%$4.04

18.05%$61.78

3.55%$3.45

7.32%$20.57

2.65%$8.15

4.80%$0.03644192

7.14%$0.03356597

5.46%$0.930481

5.79%$0.256286

5.78%$3.52

13.05%$0.411621

7.58%$0.724294

4.33%$30.10

3.41%$0.112294

5.36%$0.00594888

6.21%$1.23

6.65%$0.03227195

3.20%$31.44

5.26%$0.778804

7.55%$29.59

6.14%$0.273238

0.09%$40.01

5.63%$2.35

7.71%$0.859916

8.27%$0.310036

5.83%$3.71

6.09%$0.00346255

5.73%$0.00000034

8.07%$0.155822

9.13%$24.59

6.69%$0.400727

9.71%$24.80

5.31%$36.18

4.79%$0.0207542

8.38%$14.00

-1.51%$0.378376

12.04%$0.285318

8.04%$62.05

0.92%$0.676437

53.13%

Financial heavyweights are facing a tough time in 2020. Data from financial education site Buy Shares published Wednesday showed that banks recorded decreased profits and a significant markdown in market capitalization since the start of this year.

Amidst coronavirus concerns between the fourth quarter of 2019 and the second quarter of 2020, the global market capitalization of the banking market dropped by a staggering 30.32%.

In Q4 2019, the market cap was $8.97 trillion, while in the second quarter of 2020, the figure stood at $6.25 trillion, the report stated. This coincided with the start of the pandemic as governments around the world took strict stances, such as nationwide lockdowns and tightening economic policies.

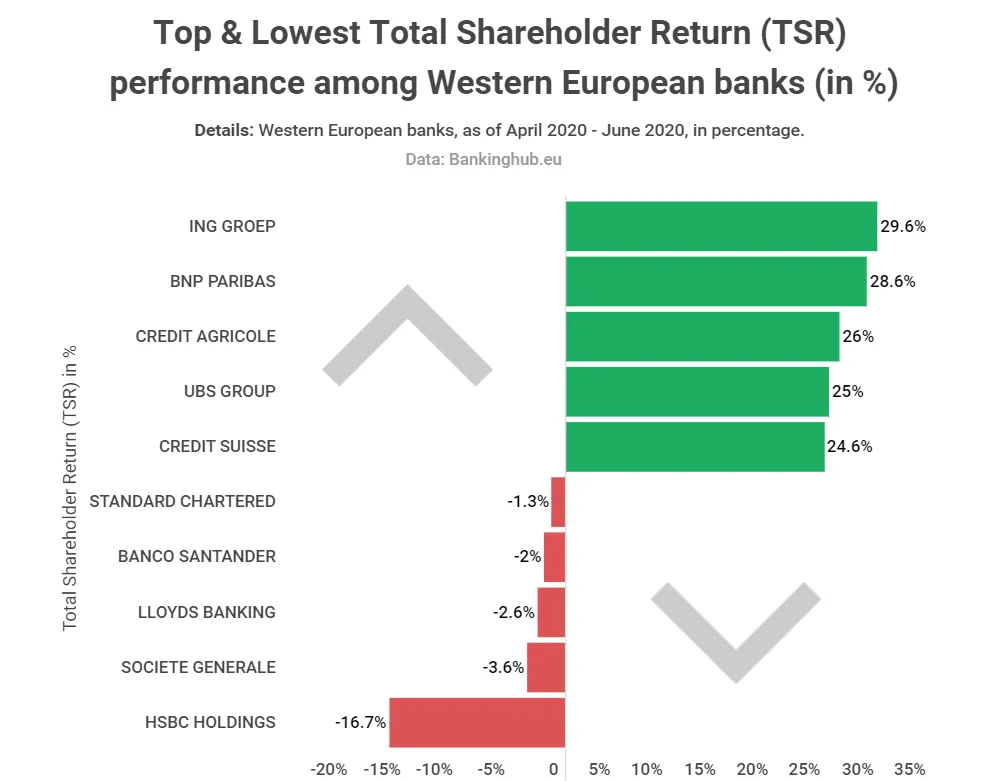

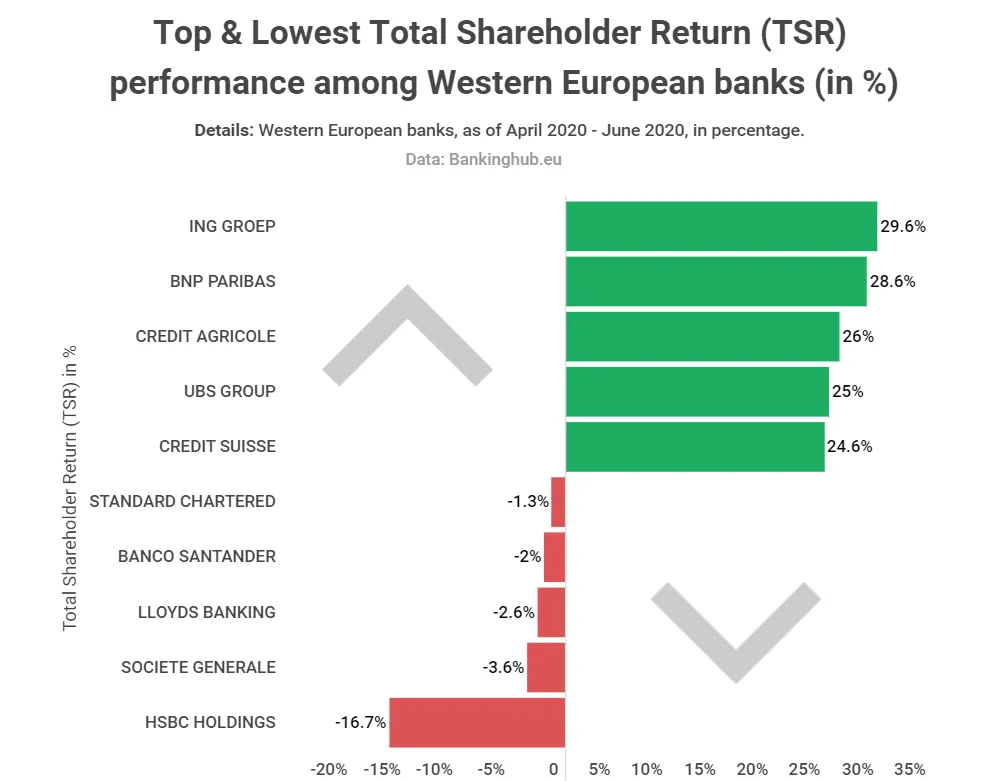

Shareholders were similarly impacted. Hong Kong’s Standard Chartered and Spain’s Banco Santander had returns of -1.3% and -2% respectively. Meanwhile, UK-based HSBC Holdings saw stock values drop -16.7%, the worst among all banks.

European banks fared better in this regard: Switzerland’s Credit Suisse and Dutch conglomerate ING put up 24% and 29.6% returns for their shareholders.

Justinas Baltrusaitis, a financial analyst at Buy Shares, said the reduction in market capitalization was a direct result of the coronavirus. “Despite mitigation measures in place, the pandemic has raised the credit risk for most banks,” he said.

“The economic uncertainty resulting from the health crisis has a meaningful impact on the real economy, and a slump in economic activity raises banks’ loan losses,” he noted.

Since the start of the fourth quarter of 2019, the entire crypto market cap has risen from $220 billion to its current $363 billion today—up 65%.