In brief:

We do the research, you get the alpha!

How did the Bitcoin bet go down?

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.

$61,062.00

-4.58%$2,968.05

-4.19%$6.53

-2.19%$542.69

-0.49%$131.12

-6.52%$1.00

-0.09%$2,963.24

-4.21%$0.490338

-1.79%$0.144945

-7.41%$5.84

-10.98%$0.44134

-3.77%$0.00002173

-4.10%$33.67

-3.64%$0.109161

-3.28%$61,080.00

-4.49%$463.76

-3.48%$13.02

-3.46%$0.662056

-5.65%$79.40

0.25%$5.38

-0.58%$11.82

-4.54%$5.81

-0.81%$6.90

-3.13%$8.97

-3.49%$0.997722

-0.57%$25.17

-4.68%$1.11

-4.32%$2.26

-4.25%$54.69

-4.53%$0.119984

-6.25%$8.01

-1.64%$5.79

-4.22%$0.106623

-2.65%$1.12

-2.98%$441.18

-11.17%$7.58

-6.50%$3,138.62

-3.75%$0.078245

-2.61%$0.03740617

-7.79%$1.87

-2.12%$0.116206

-3.06%$1.001

-0.24%$2.36

-12.29%$25.46

0.48%$0.238273

-6.45%$2.15

-3.72%$3,071.26

-4.15%$116.22

-6.53%$0.00000479

-10.51%$1.93

-5.99%$1.98

-2.70%$0.648685

-4.38%$1.29

7.92%$2.02

-15.83%$9.52

-10.21%$1.90

-5.19%$3,271.63

-3.39%$1.24

1.62%$23.86

-3.58%$0.04009973

-3.86%$4.40

-14.36%$101.14

-2.53%$3,031.85

-4.50%$0.488644

-4.11%$0.02573302

-7.45%$0.165708

-4.40%$9.45

1.52%$0.00013189

-7.68%$64.25

-4.77%$0.02475443

-17.41%$0.839927

-5.40%$0.925313

-7.12%$83.11

-3.40%$0.860928

-16.44%$0.03148858

-2.14%$0.00000123

-4.98%$2,966.61

-2.45%$16.53

-10.94%$0.771091

-4.96%$1.13

-1.28%$13.54

-2.50%$39.47

-2.54%$0.795534

-5.89%$0.549498

-9.42%$6.87

-1.82%$0.110076

0.29%$2.10

-0.94%$3.06

-3.73%$0.00004871

-6.69%$0.423636

-2.96%$0.00001384

-5.94%$0.932883

-6.40%$4.73

-4.84%$2.73

-5.70%$0.02037554

-7.91%$0.225314

-5.17%$6.61

-2.67%$15.51

-1.86%$1.21

-6.51%$3.77

-5.29%$41.49

-3.49%$0.563724

-5.06%$0.01737491

-5.19%$323.16

-3.38%$0.72247

-3.81%$0.756117

-2.74%$156.06

-5.72%$0.420154

-2.76%$8.14

-3.48%$1.19

-1.64%$1.15

-0.57%$2,988.95

-4.01%$0.974565

-0.80%$12.19

0.01%$0.213761

-4.21%$0.634819

-2.42%$0.627521

-8.18%$2.68

-2.00%$1.19

-6.03%$2,972.83

-3.66%$4.05

-6.53%$17.61

-9.07%$2.10

-0.88%$0.998229

-0.24%$0.176993

-2.51%$1.55

-9.31%$3,109.78

-4.69%$155.31

-5.67%$0.089328

-3.40%$34.30

-5.52%$0.904341

-2.99%$2,380.21

-0.01%$0.00169655

-6.08%$3.53

-5.02%$5.93

-3.57%$0.369916

-6.08%$0.00009707

-4.97%$3,154.78

-4.15%$86.44

-6.72%$1.78

-0.50%$0.096019

-2.48%$0.658194

-13.88%$0.051085

-6.34%$0.081831

-3.54%$0.00000025

-7.66%$5.33

-2.21%$0.059981

-5.56%$1.44

-1.94%$0.03680334

-1.06%$0.274924

-2.71%$0.999186

-0.25%$0.422635

-2.02%$0.823379

-5.60%$0.00883104

1.39%$3,206.81

-3.57%$0.050817

-5.27%$0.089425

-4.92%$0.315689

-1.94%$0.359446

-8.08%$0.228123

-3.61%$0.00000045

-4.09%$1.77

-9.06%$2,396.43

-0.17%$0.378938

-4.80%$0.00488788

-25.29%$0.413723

-8.58%$0.02304787

-4.71%$0.04204353

-1.87%$1.007

-1.88%$0.925008

-5.63%$13.13

-2.64%$0.763661

-2.57%$0.00718141

-9.03%$0.478029

-5.57%$0.02431055

-8.68%$0.58512

-3.99%$19.74

-3.65%$0.550276

-1.88%$3.42

-9.90%$1,227.89

-4.44%$0.00683857

-4.65%$3.59

-3.77%$0.02811158

-6.05%$0.555341

-12.35%$0.00214759

-4.71%$3.63

-6.85%$4.78

-3.56%$1.44

-5.26%$0.495256

-3.53%$11.49

-2.85%$3,039.91

-4.18%$3.42

-14.80%$46.38

-24.08%$0.887976

-5.42%$0.774162

-4.78%$51.94

-2.07%$0.02940974

-3.52%$0.23371

-4.17%$0.346302

-4.60%$0.696409

-1.80%$27.70

-1.34%$2.74

2.65%$59.81

-3.93%$4.92

-5.25%$19.95

-1.16%$56.52

-2.85%$7.82

-5.37%$3.24

-2.79%$1.52

-1.96%$20.74

-2.79%$0.03192146

-4.49%$0.0343932

-3.92%$0.244087

-2.91%$29.37

-2.28%$0.872133

-2.33%$0.0241138

-16.43%$0.697824

-8.35%$0.3858

-4.82%$3.19

-20.56%$3.44

-12.84%$0.103855

2.58%$0.00564847

-3.47%$0.03130606

-5.52%$1.17

-4.67%$0.274101

-6.89%$29.97

-2.46%$27.99

-3.44%$2.53

6.82%$38.32

-3.06%$0.265293

-3.29%$0.700689

-1.15%$0.280349

-10.53%$0.294845

-2.25%$14.11

-3.45%$24.24

-54.96%$2.21

-3.03%$0.802047

-5.45%$61.41

-2.85%$3.51

-7.90%$23.44

-0.49%$0.794609

-4.06%$0.0032747

-4.81%$34.62

-8.90%$1.039

-5.87%$0.296206

-3.59%$0.00000032

0.94%$0.358172

28.34%$0.269436

-8.35%

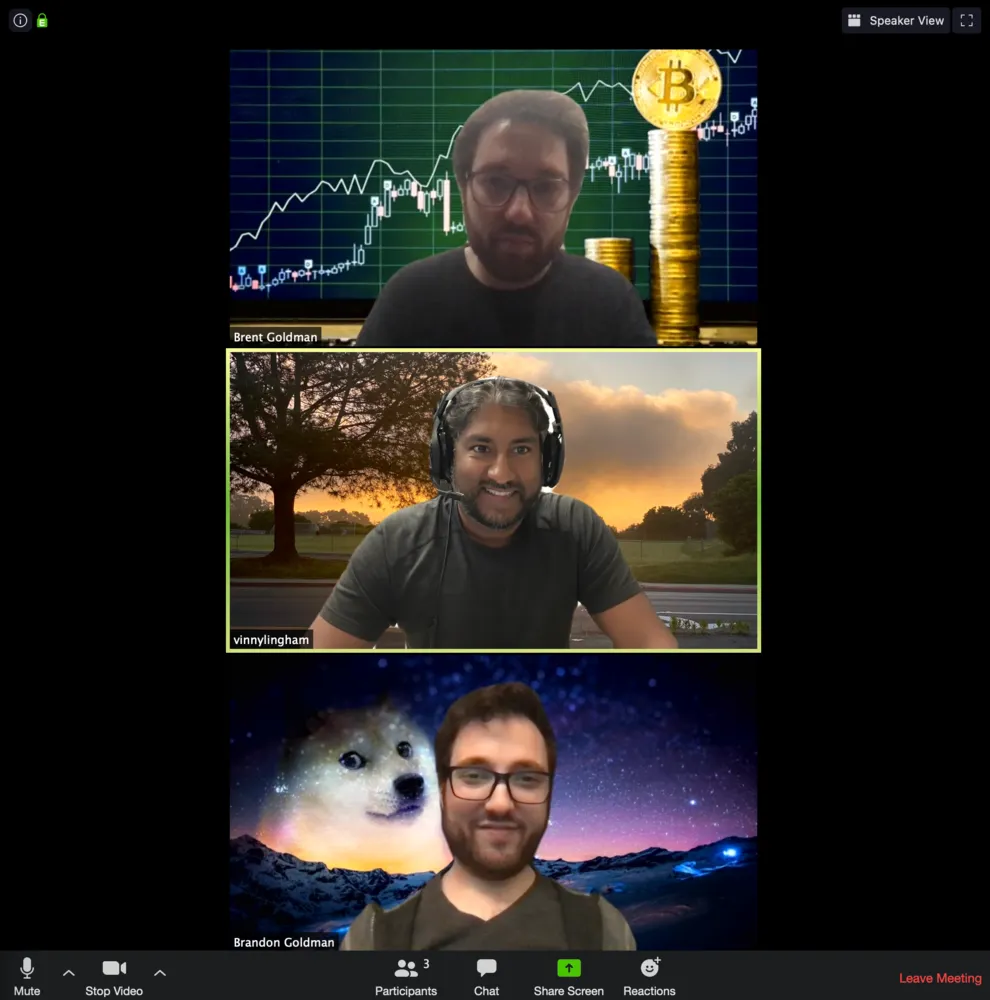

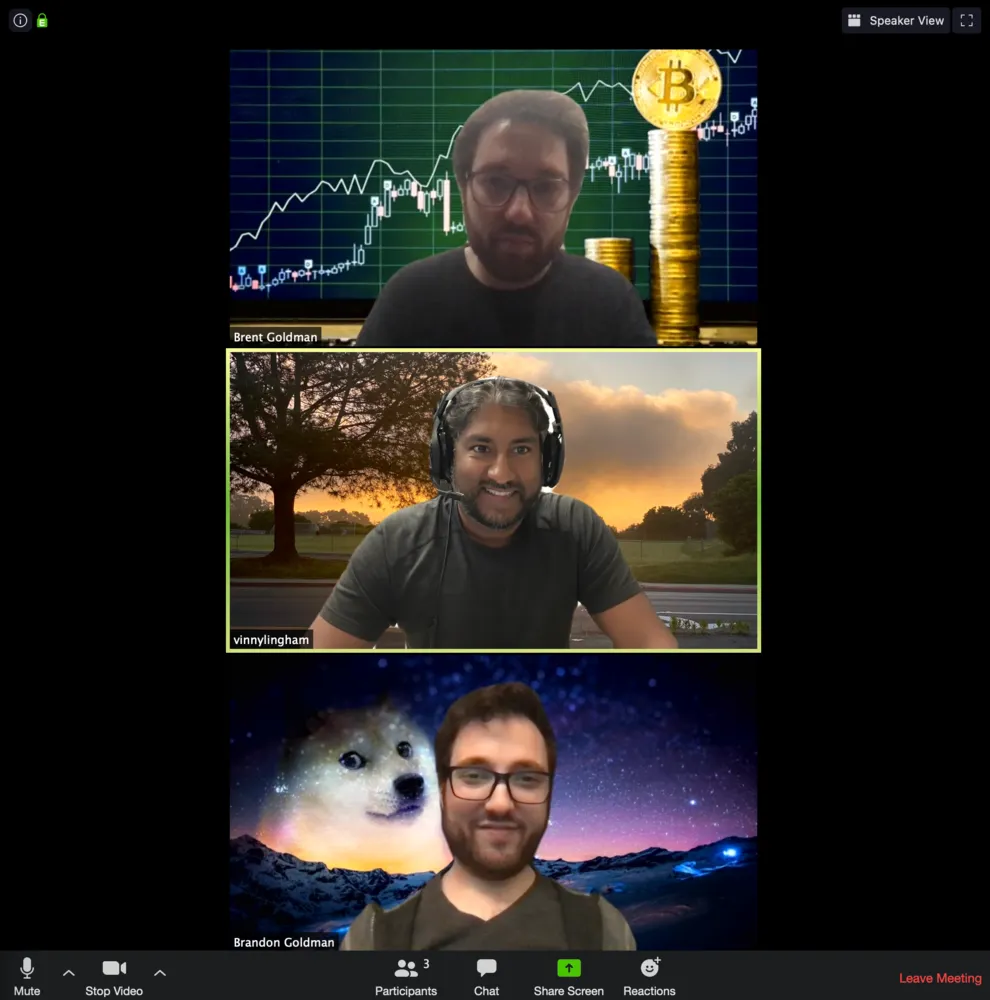

Vinny Lingham, CEO of crypto wallet maker Civic, has won his six-year-old Bitcoin bet with Brent Goldman, director of engineering for Uber’s self-driving program.

In 2013, when the price of Bitcoin was $200, Bitcoin skeptic Brent Goldman agreed to hand over a whole Bitcoin five years later. In return, Lingham agreed to pay him $1,000. 2018 passed and the two never happened to meet in person to settle it. Eventually they decided to do it remotely. On April 28, 2020, Goldman settled the bet on a Zoom call, handing over a Bitcoin, worth $7,800 at the time. Yesterday, that Bitcoin was worth a whopping $9,400.

Lingham, who remains a Bitcoin believer, was pleased with the outcome of the bet, although he wouldn’t make a similar bet today. “Right now, I'm in a wait and see mode. I think every halving introduces some risk to the ecosystem. Post halving, assuming everything goes well, I'll likely be bullish,” he told Decrypt.

But the future can wait; let’s go back to Bitcoin’s early days.

After dining at a fintech dinner in Palo Alto in September 2013, Goldman proposed the bet in an email as an informal Bitcoin futures contract.

“Future contract: Vinny buys one Bitcoin from Brent for $1,000, 5 years from today,” he wrote.

Goldman’s brother Brandon Goldman, who was also on the email chain, was confused. “If Vinny is so sure the price of bitcoin will go up, why make a futures contract for $1,000 in five years instead of just buying one bitcoin for $120 on an exchange today?” he replied.

“Where is the fun in that?” said Lingham.

Brent Goldman explained why he made the bet. At the time, he was both a Bitcoin skeptic—and an enthusiast. He found it interesting how Bitcoin solved the Byzantine Generals’ Problem (having multiple people agree on a single version of the truth) and, from an economics perspective, how it could decentralize aspects of the financial system.

“In terms of involvement, I invested in Bitcoin very early on, went to the very first meal in SF paid for by Bitcoin, evangelized with my friends, went to Vegas for the conference, etc,” he said, adding, “Last but not least, Bitcoin was also interesting from a political perspective, as my beliefs are influenced by libertarianism—though I definitely wouldn’t call myself a mainstream libertarian.”

He didn’t think the world would agree, though. “I was skeptical the rest of the world would buy into crypto so ‘quickly’,” he explained—and even if they did, he was skeptical that Bitcoin would end up being the dominant coin. “So instead of joining the crypto ecosystem myself, I attempted to bring some of its benefits to the mainstream, starting a YC-backed company [Standard Treasury] focusing on programmatic money for commercial banking,” he said.

“Fast forward seven years, and I am still a crypto enthusiast but Bitcoin skeptic,” he added. “I’m not sure what the dominant coin will be—there may even be another fork coming up in the “halvening”—but crypto is definitely here to stay.”

Although, for him, that’s crypto minus one Bitcoin.

Update: The bet was finalised in 2013, not 2014.

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.