In brief

- Fat Brands tokenizes its fast food chain Fatburger on the Ethereum blockchain.

- First-ever Morningstar Ethereum securities audit reveals some potentiality in blockchain tokenization.

- It could herald a new era in tokenization.

We do the research, you get the alpha!

Investment rating monolith DBRS Morningstar audited several securities belonging to American fast-food chain Fatburger on Friday. But unlike normal securities, these were on the Ethereum blockchain.

Fatburger issued the securities on the Ethereum blockchain. The key difference is that, by being registered on the blockchain, it’s much easier for investors to buy and sell them. The stocks can be sold in part, something known as fractional ownership.

These securities were used to help Fatburger raise $39.7 million. Following the capital injection, Morningstar—historied investment management and ratings company—provided the securities with a fairly stellar rating, reflecting the addition of Ethereum tokenized assets.

The audit praised blockchain for providing increased transparency and efficiency to the securitization process.

It noted a couple of key benefits. The evaluation revealed a “shorter forecast performance period,”—meaning a quicker return on investment—along with “higher visibility into the viability of brands.”

However, this isn’t securitization as cryptocurrency zealots would define it. Instead, according to Morningstar, the security tokens issued on the Ethereum blockchain are simply a “digital representation” of ownership. They aren’t the actual securities themselves.

“This use of blockchain and distributed ledger technology will only occur outside of and parallel to this transaction and will not govern actual ownership of the Notes,” explains the provisional rating document.

The benefits of blockchain

Using blockchain provides a greater level of transparency.

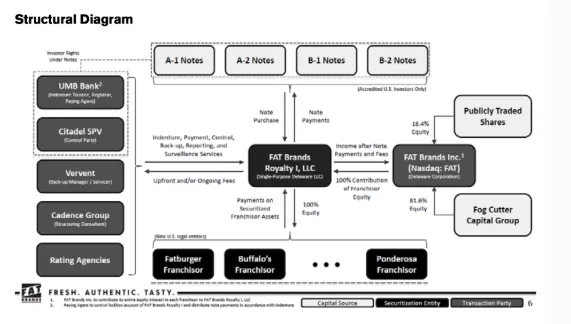

On Friday, Cadence—an investment firm acting as structuring consultant for Fat Brands' security distributions—published a diagram depicting how investors receive their quarterly payments.

The “waterfall” structure includes the distribution of three ERC-20 tokens; a set of tokens representing each tranche of securities, and a stablecoin—known as $CDG.

Nearly $40 million worth of $CDG has been issued to investors—with the trade fully executed via smart contract. Thanks to the inherent openness of blockchain technology, the entire 26 step process is visible to anyone with access to a block explorer.

“You’ll see when the money that came in, when it went out and how that whole waterfall works,” says Cadence CEO Nelson Chu, speaking to Forbes. “It’s definitely the first rated securitization with a digital asset element, and we’re using it the way it was intended: to provide that level of transparency.”

But as Decrypt recently revealed, in a feature on Ethereum names, that transparency isn’t always welcome.