We do the research, you get the alpha!

The British pound’s recent volatility may be encouraging many investors to try their hand at crypto trading if findings from a recent report from Kaiko are to be believed.

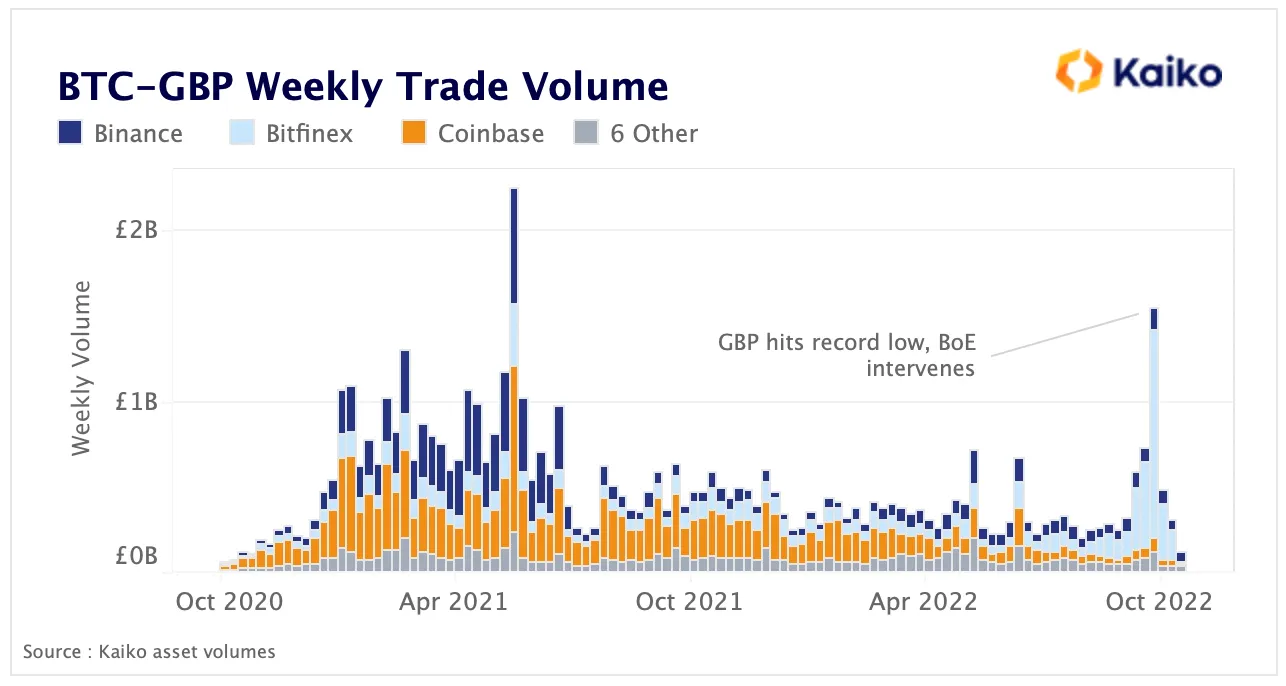

Bitcoin trading volumes reportedly surged on UK markets last month as traders may have looked to take advantage of high exchange rate volatility.

The pound has lost a significant amount of its value in recent months, hitting an all-time low against the U.S. Dollar on September 26.

Many have attributed this trend to the tax cuts proposed under former Prime Minister Lizz Truss’ premiership in the most recent budget put forward by former chief finance minister Kwasi Kwarteng.

One particular exchange, Bitfinex, received much of the benefit. Its market share nearly doubled from 37% to 70% in the week of September 26, the same week when the GBP hit an all-time low against the U.S. Dollar.

But not all exchanges have benefitted equally from the trend.

Binance and Coinbase, for example, actually saw a strong decline in BTC-GBP volumes according to Kaiko’s data, with their combined market share plummeting from 80% in mid-2021 to about 30% currently. Volumes on Binance reportedly fell in the second half of last year after the exchange was forced to pause bank transfers from the European Single Euro Payments Area (SEPA) between July 2021 and March 2022.

"Cryptocurrency exchanges are taking advantage of high fiat market volatility to expand their fiat on-ramps and trading services. At the end of September, trade volume denominated in GBP surged to all-time highs, dominated by activity on Bitfinex," Kaiko's director of research Claire Medalie told Decrypt via email. "Two weeks later, Bitfinex expanded wire transfers to include the British Pound through a quicker payment service."

Crypto traders turn to fiat

This is not the first time that investors have turned to crypto amid falling fiat currency prices.

During the last quarter of 2021, crypto trading volumes using the Turkish lira jumped to an average of $1.8 billion a day across three different exchanges, according to data from blockchain analytics firm Chainalysis.

The Lira lost around 41% of its value last year and had been struck hard by a mixture of U.S. tariffs on key exports as well as wider macroeconomic and political issues.

Some exchanges are also looking beyond the pound and lira, according to Medalie.

"Other exchanges have also followed suit, expanding fiat currency services. FTX recently launched a USD-linked perpetual futures contract allowing traders to bet on the value of USD relative to other currencies. As crypto market volatility falls, exchanges are searching for new ways to attract traders," she said.

But it’s not just UK investors that are looking towards Bitcoin, BTC’s market share of volume versus all other altcoin trading pairs climbed to its highest level in two years in September, according to Kaikio’s report.