We do the research, you get the alpha!

$63,479.00

4.39%$3,062.65

3.14%$6.76

3.24%$549.47

3.10%$140.15

5.27%$0.999731

0.21%$3,060.04

3.20%$0.501877

2.13%$6.53

7.59%$0.15082

2.65%$0.455242

2.80%$0.00002275

3.70%$34.85

3.15%$63,435.00

4.31%$0.108911

-0.84%$484.16

4.78%$13.70

4.38%$0.673384

0.86%$5.74

6.49%$80.92

2.24%$12.64

6.11%$7.28

5.72%$5.84

0.41%$9.40

2.19%$26.15

3.44%$1.16

0.71%$0.998985

0.55%$2.46

9.10%$55.69

0.64%$0.122834

1.34%$5.99

3.17%$8.26

2.41%$0.110063

2.35%$466.72

3.49%$7.91

1.56%$1.14

3.18%$0.082264

5.45%$0.03962981

4.29%$2.00

7.25%$3,070.31

-3.40%$0.119231

2.23%$2.57

4.70%$28.11

2.82%$0.255913

6.03%$0.999925

0.15%$2.23

2.32%$3,173.17

3.09%$2.07

4.38%$0.0000051

3.61%$116.72

-2.12%$2.07

4.80%$0.691739

1.91%$2.06

-3.29%$10.07

-1.30%$2.00

4.48%$1.25

0.30%$3,381.43

3.01%$25.22

3.22%$0.04336965

8.25%$4.85

2.12%$1.25

-3.35%$108.08

7.00%$3,134.40

2.80%$0.535005

5.67%$0.17436

2.63%$0.02629697

3.19%$1.016

6.94%$9.38

1.86%$0.0001384

3.75%$67.04

3.15%$0.878469

4.24%$0.915611

-1.79%$18.24

3.28%$85.52

2.18%$0.03229199

1.15%$0.00000127

1.88%$3,056.06

2.51%$0.794007

-1.25%$1.15

2.69%$13.83

2.96%$40.73

2.66%$0.847787

4.88%$0.588193

3.97%$2.21

5.29%$7.05

2.15%$0.00005121

3.63%$0.43919

2.48%$3.12

0.85%$0.00001469

5.24%$5.07

8.20%$0.108089

-0.76%$0.971726

3.39%$2.84

1.92%$3.98

6.11%$0.614215

5.40%$0.232945

0.29%$43.31

2.23%$6.78

1.01%$1.24

0.63%$15.84

2.25%$0.01848876

3.78%$0.02006392

-5.36%$337.38

4.58%$0.756864

3.24%$165.89

3.99%$0.788498

2.95%$8.53

5.81%$0.433436

2.19%$1.25

5.09%$1.20

4.70%$0.01515456

-37.68%$3,086.99

2.87%$0.22302

3.55%$0.665672

3.66%$18.97

8.72%$0.977461

0.01%$12.39

4.50%$1.71

6.77%$0.643453

0.30%$2.21

5.35%$2.76

3.82%$1.22

1.98%$3,056.17

2.30%$0.186391

5.25%$4.06

-2.73%$3,215.01

2.85%$0.998381

0.37%$165.36

4.21%$0.09397

3.35%$35.55

1.21%$0.393482

4.53%$3.69

1.21%$0.920269

-0.07%$92.37

6.94%$0.00171258

-0.57%$0.00010089

2.18%$2,380.51

0.54%$5.95

-2.53%$3,260.73

3.10%$0.099821

2.66%$0.085802

6.80%$0.00000027

4.06%$0.053254

2.74%$1.78

0.37%$0.675097

-0.87%$0.03875049

4.98%$0.290337

4.74%$0.063674

14.15%$1.49

4.33%$5.38

0.85%$0.861784

3.15%$0.00934718

0.78%$0.43194

1.76%$0.999171

0.59%$0.053677

3.37%$3,310.82

3.18%$0.093377

1.14%$0.377402

1.35%$0.408942

7.38%$0.450993

3.47%$0.326393

3.40%$0.23797

1.53%$1.83

-1.70%$0.00517752

-6.58%$0.04499573

5.56%$1.074

4.63%$0.00000045

-0.17%$14.03

20.80%$0.02434441

3.37%$0.643401

1.71%$0.97593

5.81%$2,392.65

0.38%$56.23

-0.02%$0.02604989

1.85%$0.805083

4.40%$0.506697

3.49%$13.53

1.65%$3.99

5.61%$0.608738

2.08%$0.0074108

2.16%$0.03003413

5.88%$20.30

3.66%$3.59

1.58%$3.80

3.35%$1,274.89

3.39%$0.556906

2.41%$1.53

1.68%$0.0022562

4.06%$0.00701653

2.20%$4.93

3.26%$0.51413

1.97%$0.816536

7.01%$0.929873

4.90%$3,137.58

3.00%$0.369382

6.20%$53.93

4.16%$0.03082171

2.78%$3.14

14.75%$0.243348

3.09%$1.71

10.29%$3.43

-4.60%$0.731589

7.05%$0.02873971

13.68%$29.08

5.53%$5.25

5.30%$58.83

3.43%$61.60

2.34%$20.54

2.51%$8.17

2.76%$21.85

4.58%$3.39

4.16%$0.03606103

3.08%$0.03336507

2.24%$0.916479

5.02%$3.79

5.86%$0.40953

5.29%$0.251507

2.02%$0.726561

1.10%$30.31

1.73%$3.42

-1.32%$0.00587359

2.69%$0.106922

5.57%$0.328499

11.10%$1.23

3.36%$0.03235297

1.65%$31.23

2.68%$0.279021

-1.31%$29.09

3.85%$0.301913

12.25%$0.161634

4.55%$3.69

1.91%$0.733617

7.13%$2.31

2.47%$39.66

2.61%$0.305927

3.49%$0.830724

1.89%$63.41

3.04%$36.49

1.97%$0.00000034

7.92%$24.85

-10.29%$0.00342509

4.41%$0.397703

10.11%$24.12

0.37%$14.24

-0.15%$0.3764

9.26%$0.27501

2.46%$2.53

1.57%$0.370727

8.86%

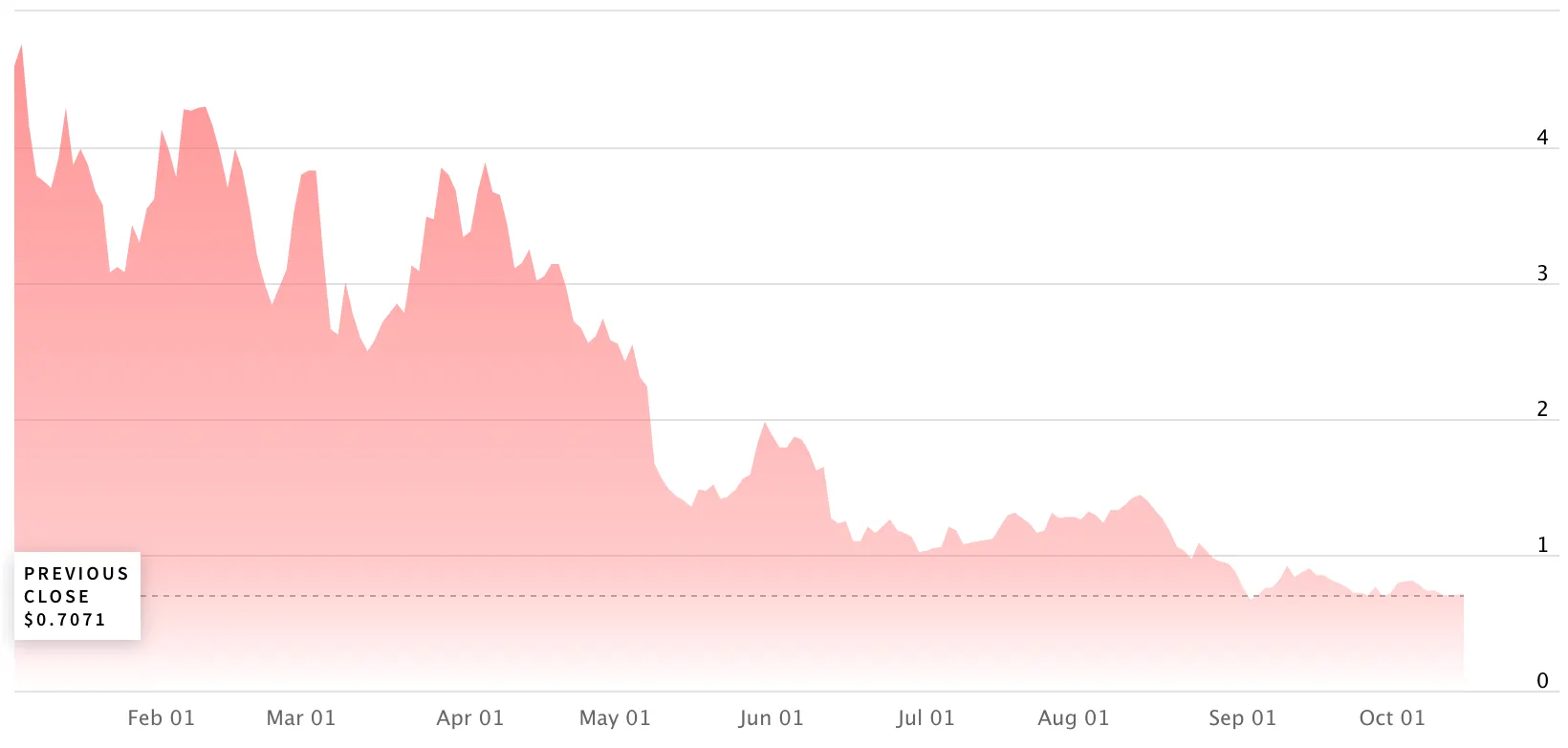

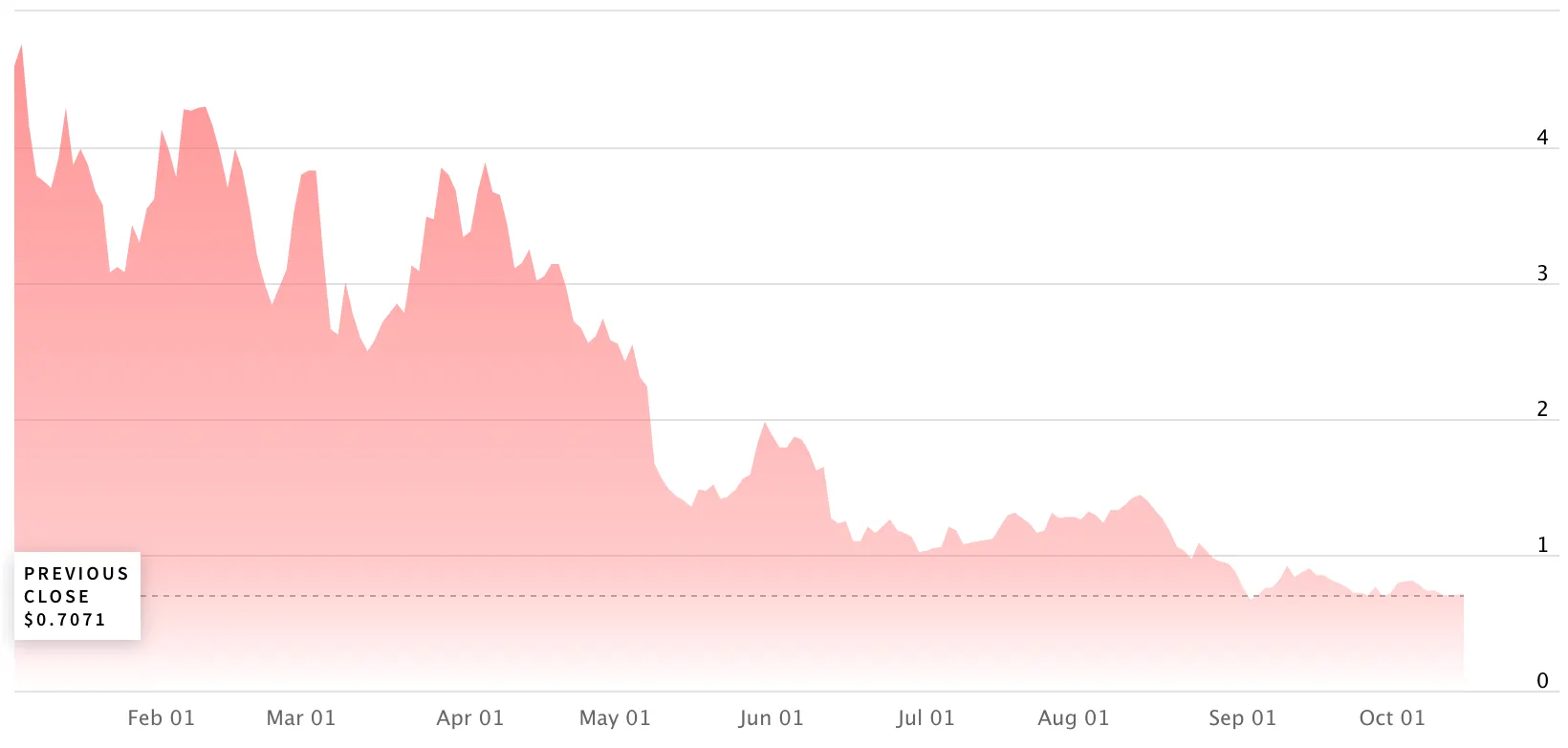

Last Monday, Digihost (NASDAQ: DGHI), the Houston-based crypto mining outfit, received a deficiency notice from Nasdaq after its stock price traded below $1 for a prolonged period, violating the exchange’s listing compliance.

According to NASDAQ Listing Rule 5550 (a)(2), a deficiency notice is issued if a company’s stock trades below $1 for 30 consecutive days.

Digihost has been provided a 180-day compliance period until April 10, 2023. The stock must trade above $1 for ten consecutive business days before this period concludes.

“If the Company does not regain compliance with Rule 5550(a)(2) by April 10, 2023, the Company may be eligible for an additional 180 calendar day compliance period,” Digihost wrote in a filing with the SEC regarding its compliance failure with Nasdaq.

On August 23, 2022, DGHI slipped below $1 for the first time since its listing on the exchange on November 15, 2021, per data from Yahoo Finance.

As of this writing, DGHI has fallen from $4.6 in January this year to $0.71 today, marking a whopping 84% drop in its price.

In the SEC filing, Digihost assured investors that it would resolve the compliance issues with Nasdaq and clarified that the company’s business operations have not been affected by the recent notice.

The primary reason behind Digihost’s failure to comply with Nasdaq’s listing compliance is likely the extended Bitcoin bear market, which dealt a hefty blow to the mining industry.

The leading cryptocurrency, Bitcoin (BTC), has lost 71.98% from its all-time high of $68,789.63 recorded in November 2021, per data from CoinGecko.

Not just Digihost but Australian-mining company Mawson Infrastructure Group (NASDAQ: MIGI) has also failed to comply with Nasdaq’s listing compliance, as its stock has traded below $1 for an extended time.