We do the research, you get the alpha!

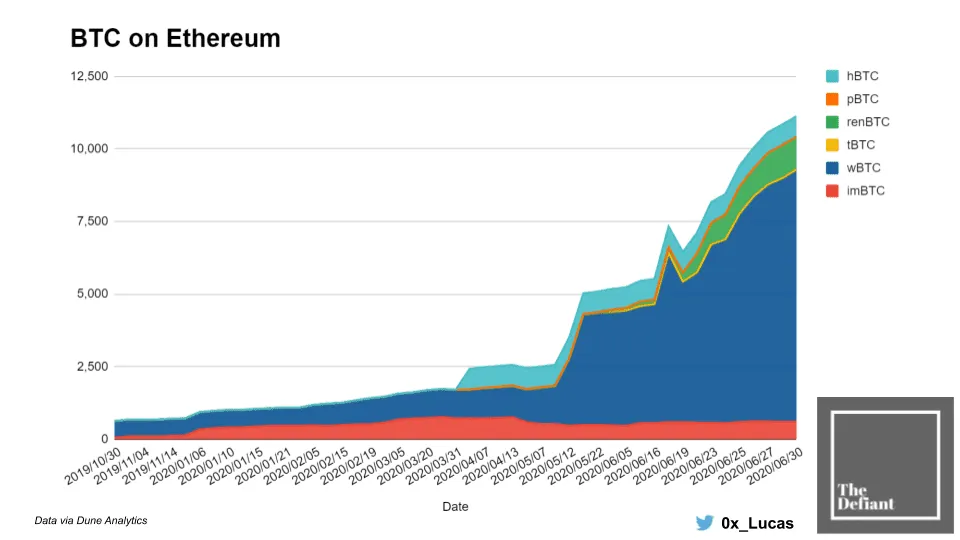

There’s now over $100M in BTC circulating the Ethereum economy. While it’s only a sliver of BTC’s total market cap, it’s undeniable that the trend is growing. At the end of the day, Ethereum acts as a gravity well for global financial assets. And Bitcoin is the first victim.

The reason? Decentralized finance. With Compound, Maker, and others now offering permissionless financial services using Bitcoin as collateral, people are electing to migrate their native Bitcoin over to Ethereum to capitalize on any of the range of “money verbs” available on the network. I mean who wants to sit around and hold BTC these days anyways? Boring.

They do this by depositing BTC and getting Ethereum’s ERC20 tokens in exchange at 1-to-1 so the coins are effectively pegged to Bitcoin. These Ethereum-ized BTC come in many flavors, from the more centralized with WBTC, to the more permissionless with renBTC.

The largest gravity well in recent weeks for Bitcoin has been Compound. After launching COMP yield farming in mid-June, the lending protocol has increased its BTC locked from ~$90M to over $570M, a 533% rise in less than two weeks.

MakerDAO Started It

Maker was the initial driver behind the spike of BTC on Ethereum, after it added WBTC as collateral in May. However, WBTC reached its debt ceiling of 10M circulating DAI, resulting in the amount of new BTC locked in Maker to flatline.

But this shouldn’t last for long, as MKR holders will likely vote to double the debt ceiling in the coming days and more Bitcoin will be inhaled by Ethereum and its decentralized reserve bank.

Another driver behind the recent surge of BTC on Ethereum is Balancer, the liquidity and asset management protocol that launched yield farming earlier this month. Balancer has soaked up 1,660 BTC into its protocol or roughly $15M in value, since June 1st.

Astronomical Rewards

The final player behind Ethereum’s gravitation of BTC has been Curve, the AMM protocol known for its highly efficient stablecoin trading. The rising AMM recently launched a BTC Pool which comprises three major flavors of BTC including WBTC, RenBTC and sBTC, Synthetix’s version of BTC collateralized by SNX.

What’s interesting about the Curve BTC pool is the underlying yield farming incentives. In case you missed it, Ren Protocol and Synthetix teamed up to provide one of the most complex multi-asset yield farming plays that the DeFi ecosystem has seen to date. Users who supply BTC liquidity to Curve will not only receive trading fees but also SNX, REN, BAL, and CRV incentives. As a result, the BTC pool has been quick to accumulate just shy of $16M in BTC in a few short weeks of launching.

The common theme here is yield farming. The incentive to earn native protocol tokens is just too tempting. People simply can’t resist using their otherwise idle BTC to earn the astronomical rewards that typically range between 30% - 100% APY.

The Battle for BTC on Ethereum

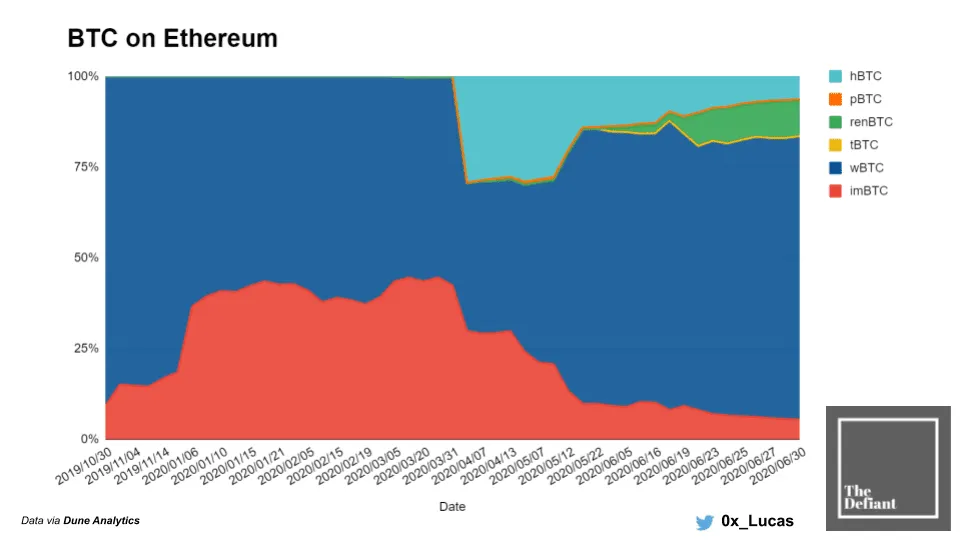

WBTC currently dominates the market in terms of tokenized Bitcoin as it’s responsible for ~78% of all BTC on Ethereum. But the introduction of Ren Protocol’s RenVM brought a new fighter into the arena - renBTC.

After launching in early June, Ren protocol’s trustless cross-chain custodian (the RenVM) has facilitated nearly $10M of new BTC onto Ethereum in the past month alone. As a result, renBTC currently comprises almost 10% of all BTC circulating on Ethereum (and rising). As mentioned, one of the reasons behind this growth was the launch of Curve’s BTC multi-asset yield farming incentives along with the launch of wbtc.cafe - a permissionless portal for wrapping BTC on Ethereum via a normal Bitcoin transaction, powered by Ren.

That along with Keep Network’s tBTC struggling to hit mainnet, renBTC has overtaken the narrative for trustless BTC on Ethereum. The only thing missing for renBTC is a wide range of integrations across DeFi protocols, something that is largely dominated by WBTC. However, as Ren continues to flex its trustless muscles, more DeFi protocols will likely support renBTC in the future.

WBTC & RenBTC Crowd Others Out

Outside of WBTC and RenBTC, the other flavors are dwindling in market share. The next two closest competitors are hBTC and imBTC which aggregate for 6.38% and 5.44% of all BTC on Ethereum, respectively.

While imBTC started off as a relatively popular alternative to WBTC, it has lost a significant portion of its market share since the beginning of the year - a decrease from 40.8% down to 5.44%. In addition, hBTC has stagnated as Huobi’s version of wrapped Bitcoin sits idle at 710 BTC in circulation since its launch in late February.

It’s becoming increasingly apparent that Bitcoin as an asset can’t fight Ethereum’s gravitational pull. The potential for BTC in DeFi protocols is simply too strong. Now, with yield farming offering insanely high passive income opportunities —though sometimes at high risk— BTC doesn’t stand a chance.

BTC on Ethereum is a thing and the trend is there. That’s undeniable. The question now becomes: How much Bitcoin will end up on Ethereum from the current 0.05%? 1%? 5%? More?

Could BTC on Ethereum flippen the amount of BTC on Bitcoin? It seems insane to even consider.

But only time will tell.

If you’re interested in tracking the day to day of BTC on Ethereum, check out these two awesome resources:

http://www.predictions.exchange/ethbtc/

—By Lucas Campbell

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]