We do the research, you get the alpha!

$70,983.00

6.50%$3,676.92

18.92%$7.51

7.67%$598.02

3.83%$184.43

6.83%$3,675.52

18.98%$0.999009

-0.08%$0.536361

4.39%$0.163043

7.90%$6.64

4.16%$0.49953

5.65%$40.01

12.11%$0.00002541

6.30%$71,187.00

6.76%$0.122969

1.19%$514.42

6.52%$17.01

0.01%$8.16

2.06%$9.20

18.20%$0.742544

7.88%$87.52

5.06%$13.51

7.07%$2.46

10.69%$5.99

1.66%$0.00001108

19.05%$31.59

13.28%$3,814.33

18.93%$11.07

10.57%$0.116175

4.43%$9.05

10.77%$2.52

11.89%$3,612.39

18.61%$0.998806

-0.06%$8.83

6.98%$0.127065

3.29%$6.12

9.56%$1.017

8.01%$0.344827

12.12%$0.112035

5.32%$2.16

10.35%$2.87

16.14%$50.97

4.05%$1.14

17.69%$0.128022

4.30%$45.36

-5.70%$3,151.19

12.74%$2.78

6.06%$413.74

12.32%$1.17

13.81%$0.0367821

6.58%$28.27

15.92%$0.916608

7.70%$1.00

-0.08%$137.65

2.38%$2.46

12.63%$7.06

4.13%$0.00003184

23.90%$4,069.21

19.03%$0.00021271

8.84%$2.23

29.85%$0.502969

30.19%$9.69

11.35%$3,784.03

18.50%$0.587394

13.25%$0.04152665

-3.58%$1.86

5.35%$1.22

4.05%$1.14

4.31%$0.188516

7.37%$0.03022907

20.36%$98.48

14.57%$99.96

4.98%$10.04

2.35%$0.955351

9.22%$6.00

11.22%$70.23

7.97%$0.936912

1.28%$1.032

10.54%$0.859008

19.41%$0.00000124

4.43%$2.15

10.39%$14.50

12.35%$0.02839993

4.90%$16.22

8.83%$7.83

9.82%$19.74

3.98%$41.26

8.53%$218.86

6.68%$0.124849

7.27%$5.11

7.31%$0.02084091

-1.21%$8.12

3.31%$0.46489

7.98%$0.00005237

6.72%$0.564769

5.13%$0.02041156

2.77%$10.18

5.56%$0.992331

8.08%$0.844245

7.00%$2.27

1.84%$2.98

10.03%$0.23769

8.87%$2.93

13.73%$6.19

19.51%$3,704.12

18.71%$3,672.47

18.93%$0.852201

4.08%$0.830952

7.88%$43.62

7.84%$352.39

16.86%$1.22

13.89%$0.465183

10.35%$218.35

6.79%$0.864309

7.63%$0.01208878

8.15%$1.30

8.70%$1.44

9.85%$4.85

7.16%$19.60

10.86%$0.233967

13.15%$0.01712561

10.74%$0.694994

4.14%$3,666.82

19.02%$0.995246

-0.71%$0.11059

8.59%$2.78

7.41%$1.05

7.52%$12.21

-3.42%$0.187386

5.80%$39.03

9.27%$3,872.36

18.97%$3,933.20

19.02%$21.02

6.87%$1.03

9.76%$0.410198

17.28%$0.997054

-0.10%$0.095936

9.32%$0.00000031

7.60%$0.00011035

5.44%$0.336643

12.79%$1.99

-1.22%$0.748759

5.82%$92.87

13.61%$2.14

10.34%$0.901929

8.35%$2,413.65

-0.95%$18.42

28.34%$3,984.97

18.98%$0.00561486

0.02%$0.472792

11.46%$4.90

8.47%$2.56

7.63%$0.556724

5.69%$0.03692459

1.65%$1.51

3.42%$0.094955

7.40%$4.27

-2.18%$1.96

6.38%$1.13

12.38%$0.999641

-0.00%$1.12

9.35%$0.02709954

11.31%$0.053219

9.62%$0.337413

7.40%$0.420349

9.96%$2.84

10.51%$0.898931

9.54%$0.04603834

4.71%$0.566535

3.53%$0.00000048

2.37%$0.447869

4.32%$1.13

4.61%$0.04707034

8.06%$4.05

22.84%$4.70

3.95%$3,775.34

19.10%$0.229668

8.84%$0.335642

12.83%$0.0090246

5.86%$5.45

7.42%$1.70

8.43%$0.272747

-0.46%$0.02447658

7.53%$4.52

7.94%$2,404.34

-0.38%$73.96

19.32%$0.03178579

9.44%$3.81

11.01%$77.26

30.54%$0.051157

20.69%$0.08253

14.04%$0.00738752

3.52%$0.540703

1.48%$0.609824

6.90%$0.00235909

8.60%$1.66

15.70%$0.423663

13.36%$20.34

10.06%$59.49

7.25%$0.00117748

5.20%$3.84

6.72%$3.72

13.29%$0.0071257

4.00%$0.999523

0.02%$1,427.17

6.97%$0.537333

3.30%$0.25475

7.67%$0.818112

3.85%$0.03872557

6.11%$24.72

5.33%$9.32

18.72%$4.64

10.48%$0.74493

5.65%$0.901353

4.06%$30.81

6.07%$7.72

-1.71%$0.03949061

5.64%$0.02952714

6.26%$0.283396

12.09%$9.72

19.86%$5.32

6.08%$3.57

8.83%$21.26

9.32%$47.52

10.02%$0.911074

7.82%$0.783589

5.77%$0.516566

18.36%$32.49

8.54%$0.03275568

3.08%$0.360792

14.94%$33.65

15.83%$0.00000082

46.81%$3,840.71

19.47%$122.95

6.31%$0.908918

3.03%$0.00405246

7.25%$79.17

16.62%$45.83

12.06%$0.96993

6.42%$2.63

5.20%$0.00094493

23.34%$0.364905

9.36%$0.381912

12.42%$0.327669

6.91%$3.59

2.74%$2.02

-0.07%$3.89

5.64%$0.426815

15.12%

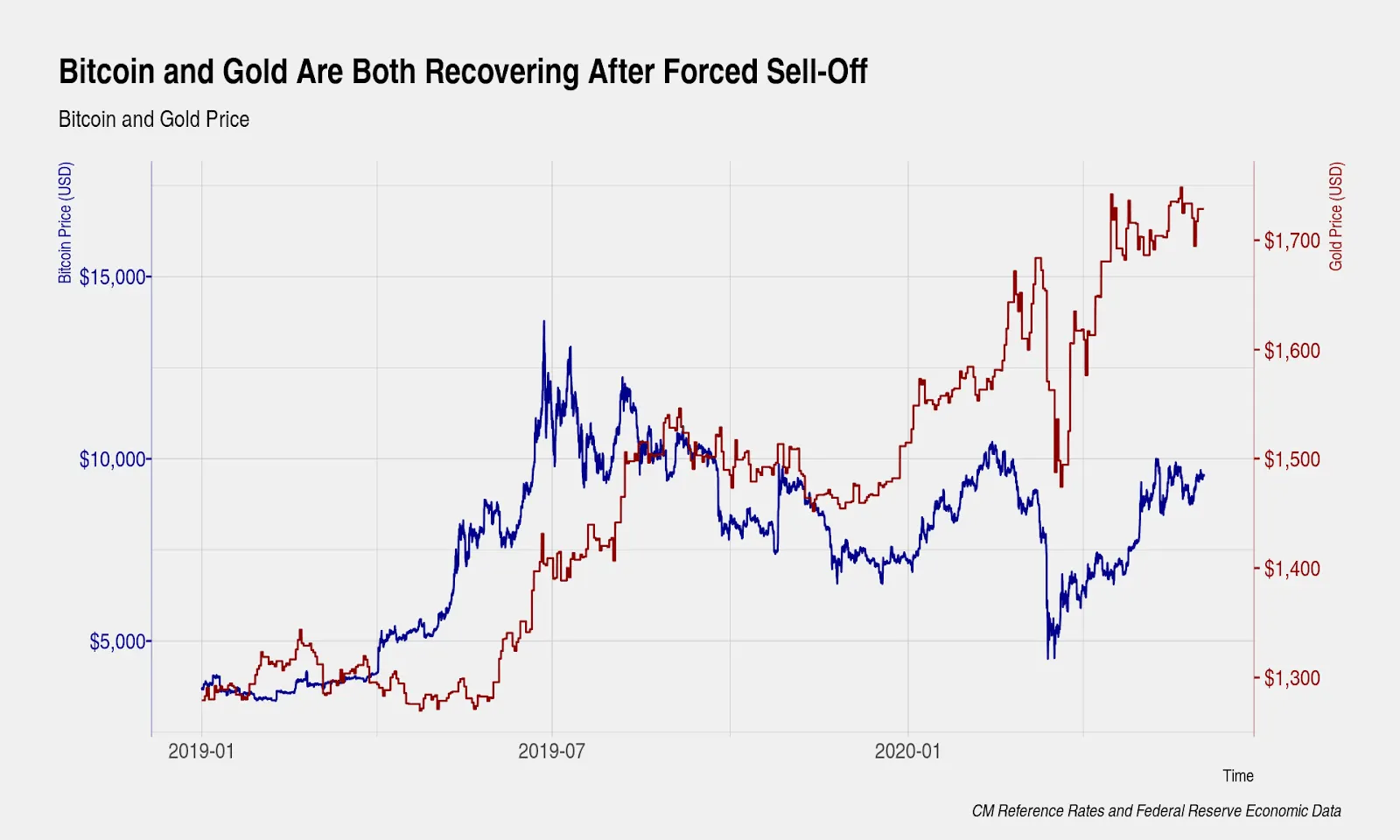

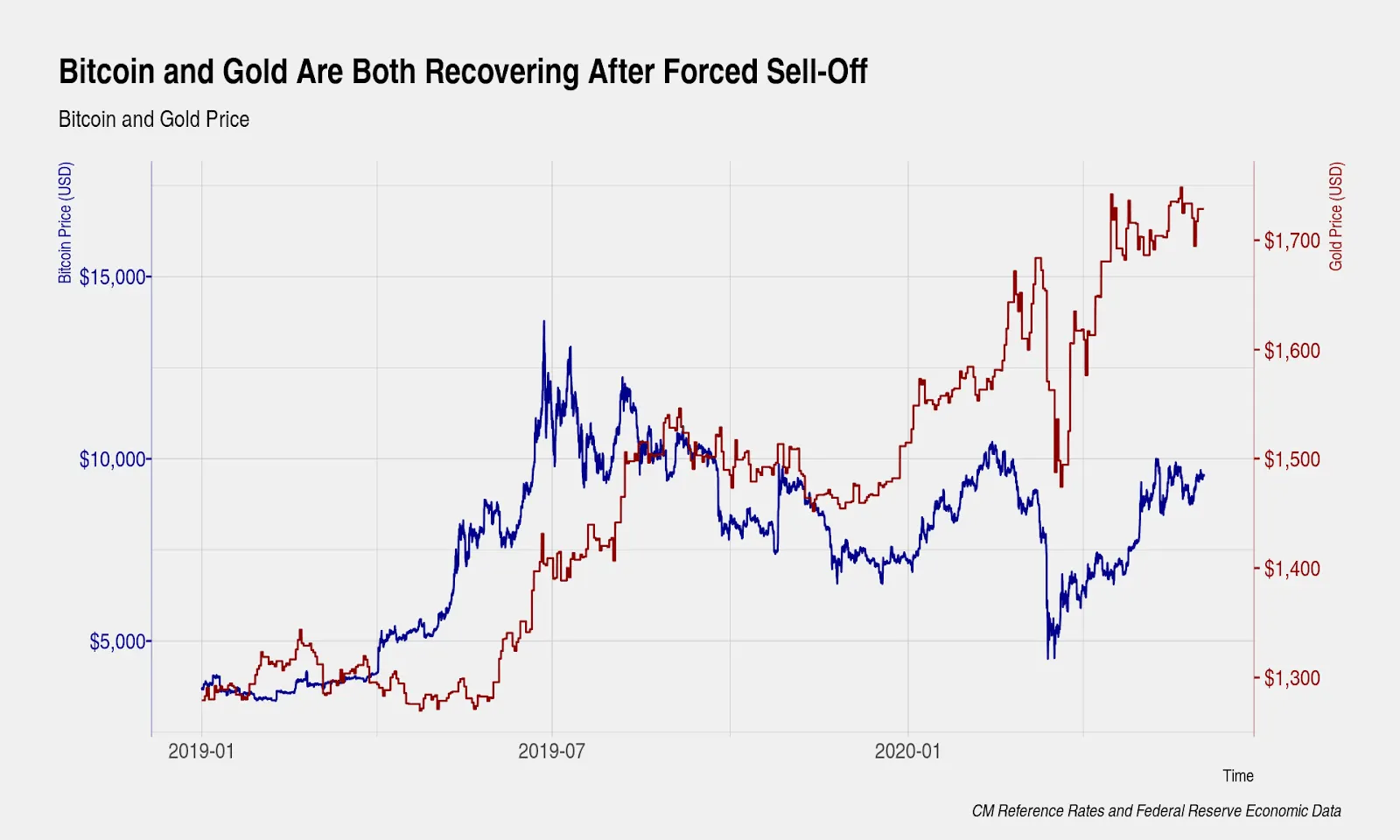

There has been wide speculation about the alleged correlation between Bitcoin and the stock market, but, according to new data, it’s Bitcoin and gold that have been moving in tandem with each other.

In its latest report, Coin Metrics shows that the correlation between gold and the world’s number one digital currency by market cap is quite high and has been so for the past several months.

As seen in the chart below, during the COVID-19 market selloff, Bitcoin lost more than half its value and fell into the $4,000 range, while gold was trading for under $1,500.

The price of Bitcoin has since risen beyond $10,000 following civil unrest in the United States and gold is currently selling for more than $1,700.

The chart above from Coin Metrics suggests that February and March saw Bitcoin and gold reach their lowest points for the year, with BTC losing more than half its value in just a few months and gold shedding several hundred dollars. The next two months, however, would see both assets spiking alongside each other and moving into higher ranges, with BTC hitting the $9,000 mark and gold shooting back above $1,700.

Data released in April from mutual fund manager VanEck backs this up. It shows that correlation between Bitcoin and gold has been the norm ever since the market selloff in late February, which occurred during the initial spread of the coronavirus.

From mid to late March, Bitcoin’s correlation with gold shot up to 0.47, where 1 is a strong positive correlation and -1 is a strong negative correlation.

At the end of April, the correlation between Bitcoin and gold increased to 0.49, while VanEck notes a year-to-date figure between the two of 0.42. This shows that Bitcoin and gold have been correlated closely over the last year.

But this hasn’t always been the case. Looking at the relationship between Bitcoin and gold from 2012 to March 2020, there is no correlation between the two assets—at just 0.03. This is likely due to Bitcoin’s huge price rise during that time.

“We note that bitcoin’s correlation with traditional asset classes have begun to increase during the COVID-19-induced global market selloff,” wrote VanEck. “Most notably, Bitcoin’s correlation with gold has reached levels never seen before. We believe this may further cement its potential as ‘digital gold.’”

Although, since Bitcoin's price dropped $700 in minutes within the last hour, this correlation may be more hopeful than factual.